Cleveland-Cliffs (CLF) is an American steel producer. It is the largest manufacturer of flat-roll steel and iron pellets in North America. (See Insiders’ Hot Stocks on TipRanks)

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors.

Q3 Financial Results

Cleveland-Cliffs reported revenue of $6 billion for Q3 2021, compared to $1.6 billion in the same quarter last year, and beat the consensus estimate of $5.64 billion. It posted a profit per share of $2.33. That compared to a loss per share of $0.02 in the same quarter last year and beat the consensus estimate of a profit per share of $2.26. The company has $2.2 billion in liquidity and carried $5.35 billion in long-term debt at the end of Q3. (See Cleveland-Cliffs stock charts on TipRanks).

For full-year 2021, Cleveland-Cliffs expects revenue of $21 billion versus just $2 billion in 2019. CEO Lourenco Goncalves noted the remarkable growth and said that profitability also continues to increase as the company implements a modern and efficient way of doing business.

Corporate updates

Cleveland-Cliffs has agreed to acquire Ferrous Processing and Trading Company (FPT) for $775 million to enter the scrap business. Detroit-based FPT runs 22 scrap processing plants. It currently processes about three million tons of scrap annually. About half of its production is prime grade, making it one of the top prime ferrous scrap processors and distributors in the U.S. In addition to expanding into the scrap business, the company expects the FPT acquisition to contribute to reducing its carbon emissions. It expects to close the transaction in Q4 2021.

Cleveland-Cliffs generated record free cash flow in Q3. It used the money to retire its outstanding preferred shares. It explained that eliminating the preferred shares was equivalent to doing a 10% share buyback.

The company reported that its vaccination incentive program has worked well and encourages other steel companies to do the same. In collaboration with labor unions, Cleveland-Cliffs launched a program where employees received at least $1,500 for getting a COVID-19 vaccine. The company promised an additional $1,500 to employees at sites with a vaccination rate of 75%. After about a month, the companywide vaccination rate hit 75%, compared to 35% when the program launched. Cleveland-Cliffs aims to achieve herd immunity at the majority of its locations in an effort to defeat the pandemic.

Risk Factors

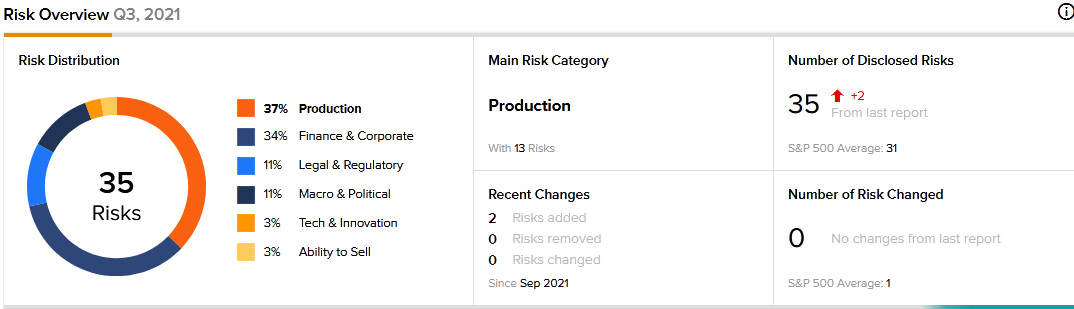

Cleveland-Cliffs carries 35 risk factors, according to the new TipRanks Risk Factors tool. Since September 2021, the company has updated its risk profile with two new risk factors, all related to the FPT acquisition.

Although it considers the FPT acquisition important, Cleveland-Cliffs cautions that it may fail to complete the transaction. It says the deal requires regulatory approvals before it can close, and there is no guarantee the approvals will be granted. The company goes on to warn that the deal could collapse if not completed by early April 2022 unless the parties agree to extend the deadline.

Cleveland-Cliffs tells investors that even if it succeeds in closing the FPT acquisition, it may not achieve the anticipated benefits. Additionally, it may face difficulties absorbing FPT, which could hinder its ability to realize the expected cost savings.

Analysts’ Take

On October 26, Morgan Stanley analyst Carlos De Alba reiterated a Hold rating on Cleveland-Cliffs stock and raised the price target to $22.50 from $21. Alba’s new price target suggests 7.98% downside potential.

Consensus among analysts is a Moderate Buy based on 2 Buys and 1 Hold. The average Cleveland-Cliffs price target of $27.83 implies 13.82% upside potential to current levels.

Related News:

Lightspeed Announces New Flagship E-Commerce Product

Suncor Swings to Profit in Q3; Shares Pop

Apple Drops 3.5% as Q4 Revenues Disappoint, Supply Crunch Hurts