The municipal bond market, as bank stock Citigroup (NYSE:C) discovered, is not an especially hospitable place these days. At least, it wasn’t for Citigroup, who folded up its collective tent in that operation and bugged out altogether. Investors weren’t exactly pleased, but weren’t exactly horrified either, sending Citigroup shares down fractionally in Friday morning’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The word, which came from interim Head of Banking Peter Babej and Head of Markets Andy Morton, declared the economics for the division “no longer viable.” The closure won’t be immediate, and at last report, will take until the end of the first quarter to wind everything down to the point where the division can be shuttered fully. As for the staff, most of them, at last report, are leaving the bank. Whether it was of their own volition or as the result of layoffs, the result is the same: many people who aren’t working for Citigroup any more.

Part of a Larger Push

Tracking down the ultimate why behind the matter leads to some intriguing possibilities. Reports suggest that the municipal bonds wing was shuttered largely at CEO Jane Fraser’s insistence, and part of her larger overall project to transform Citigroup’s operations and improve overall profitability. That’s likely to be welcome for investors, but some might wonder if she’s not jumping the gun on shutting down an entire field of investment. After all, conditions on the ground are more than a little strange right now. They have been for some time, really. But after months of review, reports note, those factors may already have been accounted for.

Is Robinhood a Buy or Sell?

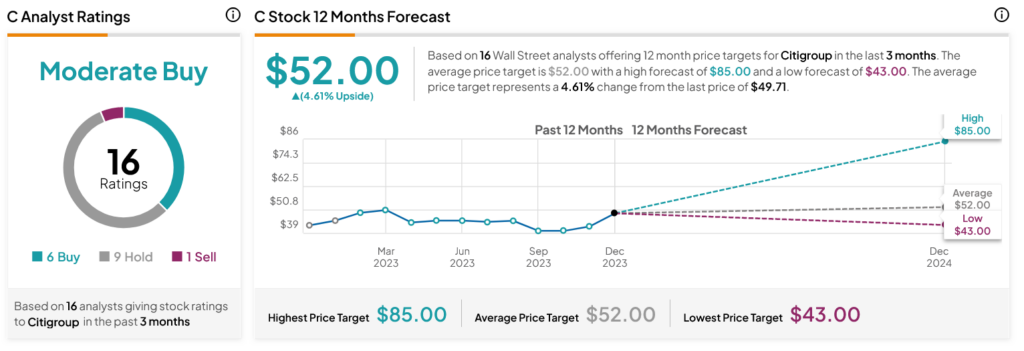

Turning to Wall Street, analysts have a Moderate Buy consensus rating on C stock based on six Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 17.78% rally in its share price over the past year, the average C price target of $52 per share implies 4.61% upside potential.