Investors of Citigroup Inc. who purchased company shares between January 15, 2016 and October 12, 2020, and lost more than $100,000 have been encouraged by Rosen Law Firm to join a class action lawsuit before the lead plaintiff deadline expires on December 29, 2020. The class action has already been filed and the lead plaintiffs will be representing and acting on behalf of other class members in directing the litigation.

Citigroup (C) has been accused of a host of indiscretions that allegedly caused investors to suffer damages once details of these transgressions were made public.

The charges relate to Citigroup’s lack of corporate governance, risk management, compliance and internal control systems, in addition to making false or misleading statements. Furthermore, Citigroup has been accused of having outdated processes and under-qualified personnel that exposed the company to regulatory, legal, business and reputational risks.

The lawsuit hopes to compensate Citigroup investors for damages under the federal securities laws.

Rosen Law Firm represents investors around the world, focusing on securities class actions and shareholder derivative litigation. The firm has been ranked in the top three for the number of securities class action settlements by ISS Securities Class Action Services every year since 2013 and has secured hundreds of millions of dollars for investors. (See C stock analysis on TipRanks)

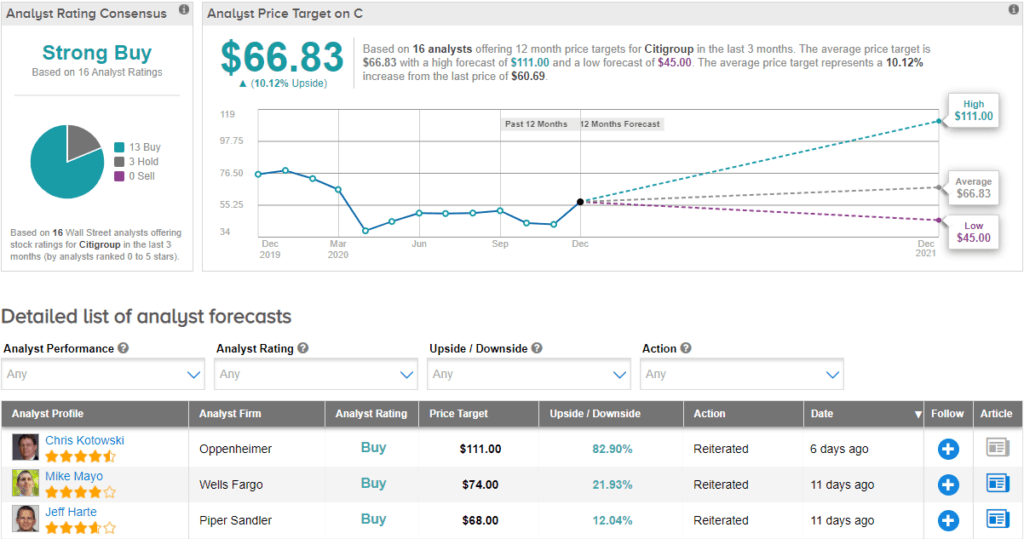

Piper Sandler analyst Jeff Harte reiterated his Buy rating recently, raising his price target on the stock from $56 to $68 (12% upside potential). Harte believes that Citigroup remains undervalued and attractive heading into 2021 despite strong recent outperformance.

Consensus among analysts is a Strong Buy based on 13 Buys and 3 Holds. The average price target of $66.83 implies upside potential of around 10% over the next 12 months.

Citigroup shares have lost around 24% in value since the beginning of this year.

Related News:

TransAlta Sells US, Canada Assets For C$439M; Street Sees 25% Upside

Shell Buys 50% Stake In Natural Gas Blocks From Colombia’s Ecopetrol

Inovio Presents Positive Covid-19 Vaccine Trial Data; Top Analyst Says Hold