Cisco (NASDAQ:CSCO) has secured clearance in the patent dispute with cybersecurity company Centripetal Networks, as reported by Reuters. A Virginia federal judge has dismissed the patent infringement claims against Cisco.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Background

Notably, U.S. District Judge Henry Morgan initially ruled in favor of Centripetal and awarded $2.75 billion in damages in 2020. Nevertheless, a later decision by an appeals court overturned Judge Morgan’s ruling, citing ethical concerns, as it was revealed that Judge Morgan’s wife owned Cisco stock.

This case began on February 13, 2018, when Centripetal sued Cisco for infringement of ten of Centripetal’s U.S. patents. Following the death of Judge Morgan, U.S. District Judge Elizabeth Hanes presided over new hearings and recently ruled that Cisco did not violate the patents.

As Cisco gets clearance in the high-stakes patent battle, it prompts a deeper analysis of its risks.

Cisco’s Risk Analysis

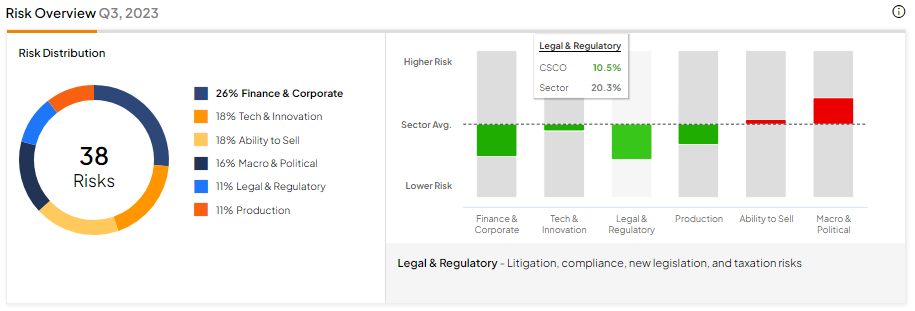

Communication equipment provider Cisco has been managing its legal and regulatory risks well. TipRanks’ Risk Analysis tool shows that its legal and regulatory risk exposure is significantly lower than the industry average.

Legal and regulatory risks account for 10.5% of its total risks, much lower than the industry average of 20.3%. While its legal risks are below the sector average, CSCO is prone to macro and political risks. It’s worth noting that Cisco’s top-line growth will likely witness a slowdown in the short term due to the ongoing macro challenges.

Is Cisco a Buy, Hold, or Sell?

Wall Street analysts remain sidelined on Cisco stock. With five Buy and 16 Hold recommendations, CSCO stock has a Hold consensus rating. Further, analysts’ average price target of $55.25 implies 12% upside potential from current levels.