Church & Dwight reported better-than-expected 4Q results. Despite the upbeat performance, shares closed 2.9% lower on Friday.

Church & Dwight’s (CHD) 4Q adjusted earnings of $0.53 per share beat Street estimates by a penny and came in ahead of the company’s guidance range of $0.50-$052 per share. However, the bottom-line result declined 3.6% year-over-year, reflecting higher marketing expenses.

Meanwhile, revenue increased 13.2% to $1.3 billion year-over-year and topped analysts’ expectations of $1.26 billion. The consumer product manufacturer reported organic revenue growth of 10.8% primarily driven by a 10.3% increase in volume and a positive product and price mix of 0.5%. (See Church & Dwight stock analysis on TipRanks)

Additionally, Church & Dwight announced a 5.2% increase in its quarterly dividend to $0.2525 per share from $0.24, reflecting an annualized dividend yield of 1.2%.

Management expects 2021 to be another solid year for the company. Church & Dwight forecasts 2021 adjusted EPS in the range of $3-$3.06, reflecting year-on-year growth of 6%-8%. Sales are projected to increase 4.5% on a reported basis and by 3% organically.

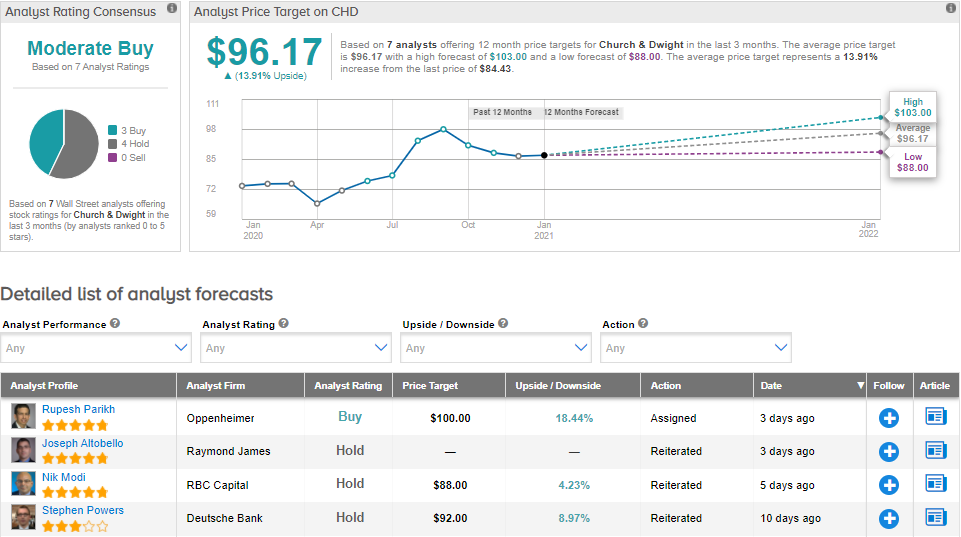

Following the earnings release, Oppenheimer analyst Rupesh Parikh assigned a Buy rating and price target of $100 (18.4% upside potential) on the stock. In a note to investors, Parikh wrote, “We look favorably on the company’s product portfolio, track record of innovation, competitive position, historical success in adjusting to changing retail environments, management team, and consistent record of execution. We believe CHD management can continue to deliver high-single-digit EPS growth in a likely more volatile backdrop going forward.”

Overall, the Street has a cautiously optimistic outlook, with a Moderate Buy consensus rating based on 3 Buys and 4 Holds. The average analyst price target of $96.17 implies upside potential of about 13.9% to current levels. Shares have gained 16% in the past year.

Related News:

Chevron’s 4Q Sales Miss Analysts’ Estimates; Shares Drop 4%

Honeywell’s 4Q Profit Tops Estimates

Mondelez’s 4Q Profit Beats Analysts’ Estimates; Street Is Bullish