Multinational energy firm Chevron Corp. (CVX) plans to invest more than $10 billion until 2028 to grow lower carbon energy businesses. The amount is more than triple the previous guidance of $3 billion and includes $2 billion to lower carbon intensity of Chevron’s operations.

Headquartered in California, Chevron offers financial management, administrative and technology support for energy and chemical operations. Shares of the company gained 2.1% on Wednesday to close at $98.24. (See Chevron stock chart on TipRanks)

The company has also set 2030 growth targets for new energy businesses. These include increasing daily renewable natural gas production to 40,000 MMBtu; raising daily renewable fuels production capacity to 100,000 barrels; growing annual hydrogen production to 150,000 tonnes; and increasing carbon capture and offsets to 25 million tonnes per year.

The Chairman and CEO of Chevron, Michael Wirth, said, “Chevron intends to be a leader in advancing a lower carbon future. Our planned actions target sectors of the economy that are harder to abate and leverage our capabilities, assets, and customer relationships.”

Meanwhile, the company continues to expect to generate $25 billion of cash flow over the next five years and earn a double-digit return on capital employed by 2025. It also reaffirmed its 2028 targets for upstream production greenhouse gas intensity, which Chevron aims to reduce by 35% from 2016 levels.

“With the anticipated strong cash generation of our base business, we expect to grow our dividend, buy back shares and invest in lower carbon businesses. We believe a strategy that combines a high return, lower carbon traditional business with faster-growing, profitable new energy ones positions us to deliver long-term value to our shareholders,” Wirth said.

Following the announcement, J.P. Morgan analyst Phil Gresh downgraded the stock to Hold from Buy and lowered the price target to $111 from $128 (13% upside potential).

The analyst said, “With the higher guided energy transition spending for lower carbon emissions… not having offsets elsewhere in the portfolio, we now see the company’s dividend coverage breakeven creeping closer to a Brent crude price of $55 per barrel, which is a bit above the group average.”

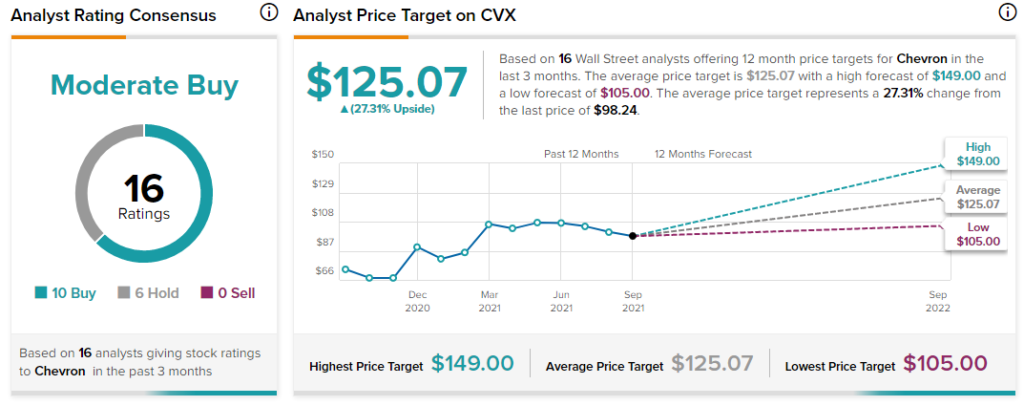

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys and 6 Holds. The average Chevron price target of $125.07 implies 27.3% upside potential. Shares of the company have gained 25.1% over the past year.

Related News:

Zoom Reveals New Reseller Partner Program for Zoom Phone BYOC

Canadian Pacific Acquires Kansas City Southern

Boeing delivers 22 planes in August — Report