Oil giant Chevron (NYSE:CVX) is hitting the ground running in 2023. Not only did it roll out a major new stock buyback plan, but it’s also made rival Exxon Mobil’s (NYSE:XOM) collective eyes pop with a new dividend plan as well. Investors welcomed the news based on Chevron’s run-up in Thursday afternoon’s trading.

Chevron kicked off its big sweep by announcing a buyback plan. A fairly normal exercise at the corporate level, but this one was a bellringer due to its sheer size of $75 billion. The part that made Exxon likely choke on its light sweet crude came from a planned hike in Chevron’s dividend, boosting the total by 6%. That puts Chevron’s dividend yield at 3.4%, which just edges past Exxon’s yield of 3.2%.

Chevron will likely need some goodwill ahead as it faces the wrath of the Biden White House. President Biden recently threatened Chevron with higher taxes, along with other energy companies who were, as Biden puts it, engaging in “war profiteering.” That’s a situation Chevron’s CEO, Mike Wirth, moved swiftly to defuse. He noted that Chevron was “in contact” with the White House on several different fronts, noting that “…sometimes, we have different ideas” of how to achieve common goals like affordable prices and stable markets.

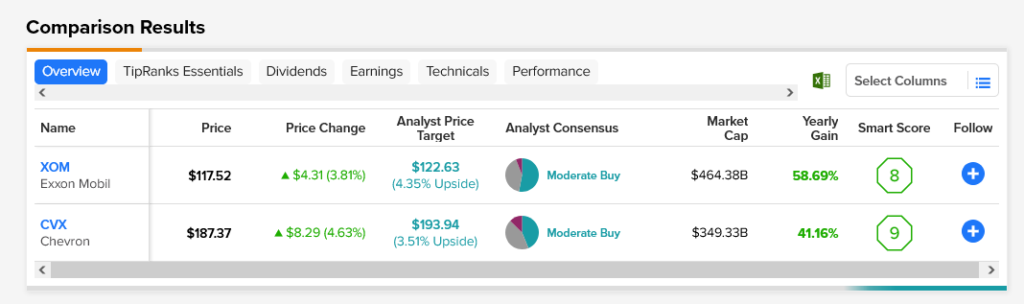

Both Exxon and Chevron are rated as Moderate Buys by analysts. Chevron stock’s average price target of $193.94 gives it 3.51% upside potential, while Exxon stock’s $122.63 average price target gives it 4.35% upside potential.