Chevron Corp. (CVX) and Enterprise Products Partners (EPD) have partnered to evaluate opportunities for the capture, utilization and storage (CCUS) of carbon dioxide (CO2) from their respective business operations in the U.S. Midcontinent and Gulf Coast. The initial phase of the study is expected to take six months.

Headquartered in Texas, Enterprise Products provides midstream energy services to petrochemicals, refined products, crude oil, natural gas liquids and natural gas consumers and producers. Meanwhile, California-based Chevron offers administrative, technology and financial management support for energy and chemical operations. (See Chevron stock chart on TipRanks)

A subsidiary of Enterprise Products and Chevron New Energies, a division of Chevron’s subsidiary Chevron U.S.A., are conducting the study to evaluate specific business opportunities. Chevron’s shares closed nearly 2% higher at $97.97 on Monday. Meanwhile, Enterprise Products’ shares gained 0.9%. (See Enterprise stock chart on TipRanks)

The projects that the companies will undertake following the evaluation will seek to combine Chevron’s sub-surface expertise with Enterprise’s midstream pipeline and storage network to create opportunities to sequester, transport, aggregate and capture carbon dioxide.

The Co-CEO of Enterprise’s general partner, A.J. Teague, said, “The joint study with Chevron is part of our growing focus on developing and utilizing new technologies and leveraging our transportation and storage network in order to better manage our own carbon footprint and provide customers with new midstream services to support a lower-carbon economy.”

Two months ago, Piper Sandler analyst Ryan Todd reiterated a Buy rating on Chevron and increased the price target to $137 from $126 (40% upside potential). In a research note to investors, the analyst said, “Crude oil tightness adds further momentum to the robust free cash flow outlooks for the integrated oils.”

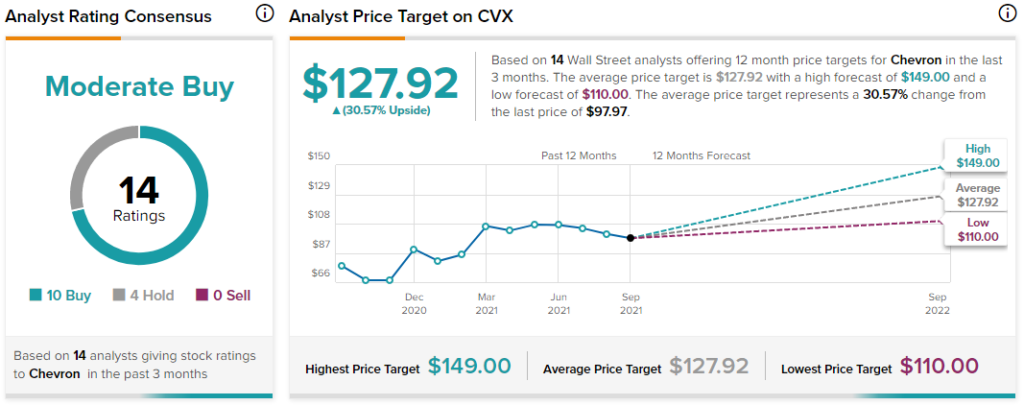

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys and 4 Holds. The average Chevron price target of $127.92 implies 30.6% upside potential. The company’s shares have gained 26.8% over the past year.

Last month, Morgan Stanley (MS) analyst Robert Kad maintained a Buy rating on Enterprise Products with a price target of $30 (34.6% upside potential). The analyst expects the company to report earnings per share (EPS) of $0.50 in the third quarter.

Overall, the stock has a Strong Buy consensus rating based on 7 unanimous Buys. The average Enterprise Products Partners price target of $28.86 implies 29.5% upside potential. Shares of the company have gained 30.1% over the past year.

According to TipRanks’ Smart Score rating system, Enterprise Products scores a 9 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Apple Hospitality Buys the Aloft in Portland

NAPCO Security Posts Record Q4 Sales and Profits; Shares Leap 16%

Alkami Acquires MK Decisioning; Shares Fall 3.4%