Yesterday, we saw that bank stock Charles Schwab (NYSE:SCHW) lost quite a bit of ground. Why? No one was sure at the time. There were several possible explanations, but none of them seemed to be just right. Now, the sell-off looks like it’s still going on, as Schwab shares lost another 8% in Friday afternoon’s trading.

So what is going on with Schwab? Well, yesterday, some thought that the possibility of a block sale routed through JPMorgan (NYSE:JPM) was to blame. Others thought a negative halo effect was in progress thanks to trouble seen at SVB Financial Group (NASDAQ:SIVB). The troubles at SVB are still going on; the FDIC shut the bank down earlier today. This was the first time the FDIC took over a bank since the global financial crisis of 2008.

However, some think that the problem is simply a massive overreaction to conditions on the ground. Michael Cyprys, an analyst with Morgan Stanley, calls the hit to Charles Schwab a “…knee-jerk reaction that compounds on long-simmering concerns about cash sorting…” Yet Cyprys welcomes this sell-off, suggesting that the result is now a “…compelling entry point…” for potential investors to get in on a solid stock.

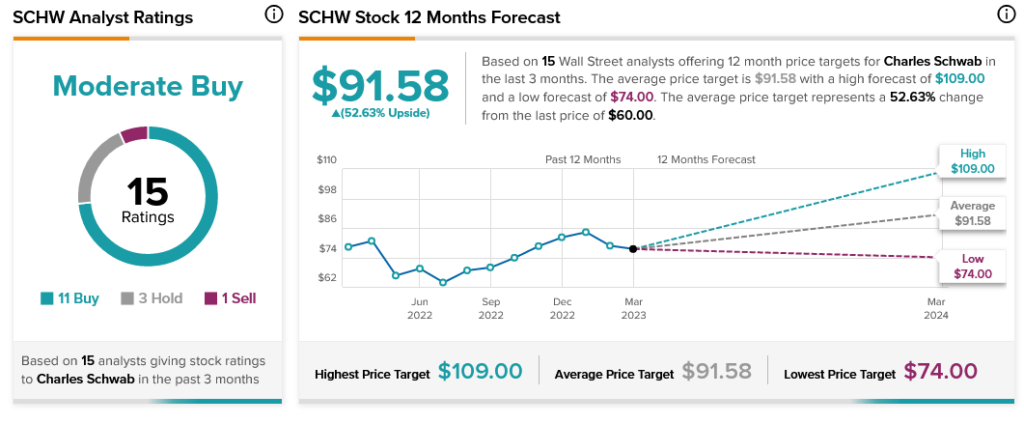

Indeed, Wall Street is very much in Charles Schwab’s corner. Analyst consensus calls Schwab stock a Moderate Buy, with Buy recommendations outpacing all others nearly three to one. Plus, it offers 52.63% upside potential by virtue of its $91.58 average price target.

How can investors see the warning signs of a company at risk? Join TipRanks’ webinar to learn more.