Shares of software-as-a-service (SAAS) provider ChannelAdvisor, Corp. (ECOM) have nosedived 30.9% so far this year. Recently, ECOM delivered a better-than-estimated fourth-quarter performance on both its top-line and bottom-line fronts.

Buoyed by double-digit growth in Subscription revenue, the Q4 revenue for the company jumped 12.7% year-over-year to $45.4 million, outperforming estimates by $1.2 million. Earnings per share at $1.19 came in ahead of estimates by $0.96.

Management noted its land and expand strategy with brands helped deliver robust performance as the company witnessed a strong increase across brands customer count, average revenue per customer, and annual recurring revenue during the year.

Furthermore, in February, ECOM achieved 2022 premier partner status in the Google Partners program. With these developments in mind, let us take a look at the changes in ECOM’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, ChannelAdvisor’s top risk category is Finance & Corporate, contributing 15 of the total 41 risks identified for the stock.

In its recent report, the company has added one key risk factor under the Finance & Corporate risk category.

ECOM highlighted that its bylaws designate the federal courts of the U.S. as the exclusive forum for certain litigation that may be initiated by the company’s investors. This provision may impose additional litigation costs on investors and may limit their ability to obtain a favorable judicial forum. On the other hand, if the enforceability of this provision is not possible, then ECOM may incur additional costs in resolving such action.

Meanwhile, compared to a sector average of 6 Legal & Regulatory risk factors, ECOM has 5.

Hedge Fund Activity

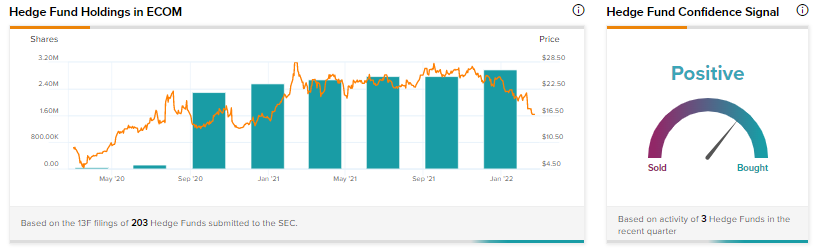

According to TipRanks data, the Wall Street’s top hedge funds have increased holdings in ChannelAdvisor by 202.1 thousand shares in the last quarter, indicating a positive hedge fund confidence signal in the stock based on activities of 3 hedge funds.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Yamana’s Q4 Earnings Exceed Estimates on Higher Gold Production

Amazon and Reliance Fight for Indian Cricket League Media Rights – Report

Aon Raises Share Buyback Authority to $9.2B, Hikes Dividend