Adam Aron, CEO of theatre chain AMC Entertainment (AMC), was delighted to share about the trading halt of both AMC shares and APE units yesterday. “On Monday, AMC was halted 3 times, APE halted 10 times!”, Aron quoted on Twitter (TWTR).

AMC’s preferred share units, called “APE” (AMC Preferred Equity) units, started trading on the New York Stock Exchange (NYSE) on Monday, August 22. Within minutes of trading, both AMC stock and APE units had breached the 5% price change. Such a breach calls for a five-minute halt in trading of the shares.

AMC stock crashed 41.95% yesterday closing at $10.46, also because of the news of rival Cineworld (CNWGY) stating that it was looking for strategic options to raise additional liquidity and the possibility of filing for bankruptcy under Chapter 11. Meanwhile, APE units ended their first trading day down 13.67% at $6.

The APE units were distributed as a special dividend last week. AMC has the authority to issue up to one billion APE units, and with the dividend distribution, it has issued a little more than half of them. Moreover, the APE units may be converted to AMC common stock in the future, depending on the Board and shareholder approval. APEs are unrelated to the AMC shares and can be traded on the NYSE.

Aron had also reminded shareholders on Sunday about the start of APE units trading on the microblogging site. Furthermore, he piqued shareholders by stating that once APE units start trading, “the value of your AMC investment will be the combination of your AMC shares and your new APE units,” instead of owning just one AMC share previously.

Is AMC Stock a Buy Now?

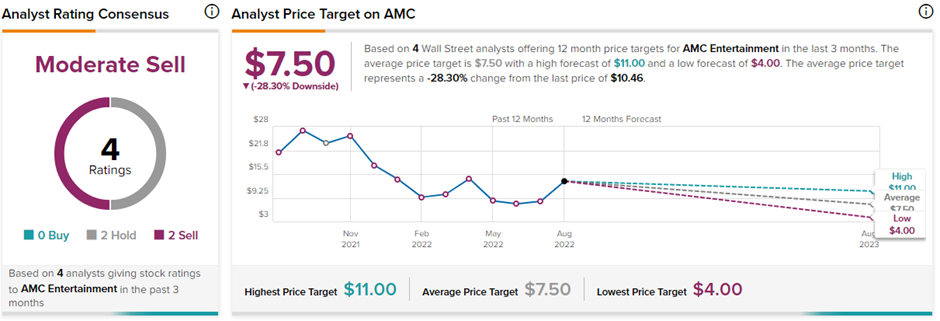

Analysts on the Street have a Moderate Sell rating on AMC stock. This is based on two Holds versus two Sells. The average AMC Entertainment price forecast of $7.50 implies 28.3% downside potential to current levels.

Recently, B.Riley Financial analyst Eric Wold commented on the APE units saying, “While we understand there was a notable level of initial confusion around the mechanics of the APEs and the potential need for a shareholder vote to unlock their value (to either shareholders or AMC), we continue to view this as a clever way for management to take advantage of the enthusiastic retail interest in the common equity over the past 18 months.”

The analyst is unsure about the level of liquidity that the APE units will generate. Nonetheless, he believes both AMC stock and APE units must trade at relatively equal prices considering that both have the same economic value and voting rights.

Having said that, Wold maintained a Hold rating on AMC stock with a price target of $11, which implies 5.2% upside potential to current levels.