Centerspace (CSR) has struck a deal to acquire a portfolio of 2,696 apartment homes in Minnesota from KMS Management for $323.8 million. It expects to close the transaction in the third quarter.

The real estate portfolio comprises 17 communities in Minneapolis and St. Cloud. Centerspace already serves 14 communities in Minneapolis with 2,537 homes and six communities in St. Cloud with 1,192 homes. The KMS deal will increase the company’s footprint in Minneapolis to 4,901 homes, while in St. Cloud, it would have 1,524 homes.

Centerspace believes the acquisition of KMS apartments will further bolster its presence in markets where it has historically performed well. The company notes that Minneapolis is home to 24 Fortune 1,000 companies with the highest median income across the Midwest.

From 2018 – 2020, Centerspace’s suburban communities in Minneapolis recorded compound revenue growth of 6.3%, while compound NOI growth was 5.8%. In St. Cloud, revenue growth was 4.7%, and NOI growth was 9.3% in that same period.

“The KMS communities have a long and successful operating history, great locations within their respective submarkets, and we are seeing high demand for product with attainable rental rates,” said Centerspace CEO Mark Decker Jr.

Centerspace plans to invest about $40 million over the next two to three years to reposition the communities it is acquiring from KMS. In addition to Minnesota, Centerspace owns and operates apartment communities in Colorado, Nebraska, Montana, North Dakota, and South Dakota. (See Centerspace stock analysis on TipRanks)

BTIG analyst James Sullivan upgraded Centerspace to Buy from Hold with a price target of $86, which suggests 19.81% upside potential.

“Centerspace share performance and valuation should also benefit from low supply in its secondary markets, improved portfolio quality, and an improving balance sheet,” commented Sullivan.

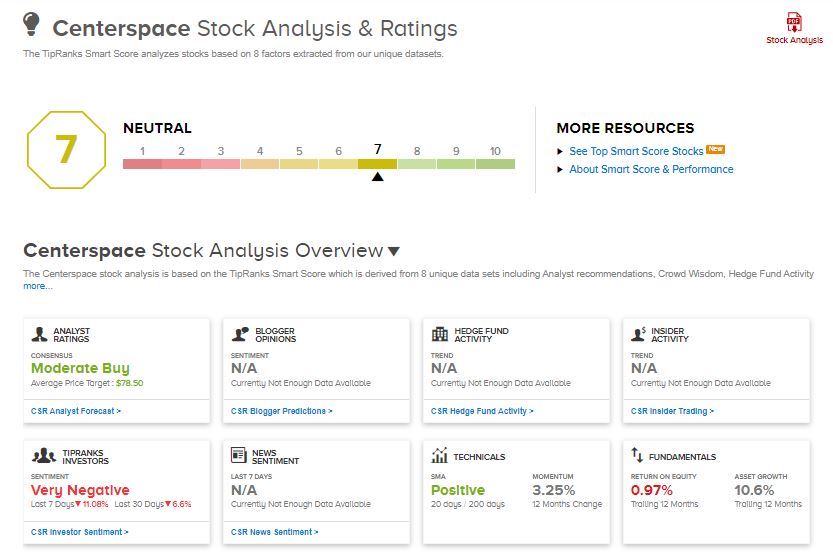

Consensus among analysts is a Moderate Buy based on 3 Buys and 2 Holds. The average analyst price target of $78.50 implies 9.36% upside potential to current levels.

CSR scores a 7 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.

Related News:

Boeing Partners with Alaska Airlines to Test New Technologies

Amazon’s Ring Moves to Boost Community Transparency

Google Cloud and Whirlpool Bolster Partnership