Earlier today, Cenovus Energy (TSE:CVE) (NYSE:CVE) reported strong earnings results for Q2 2023 that beat analysts’ estimates, sending shares higher. While Cenovus’ earnings per share fell by 63% year-over-year, the figure came in at C$0.44 compared to the consensus estimate of C$0.40. Also, Cenovus reported C$2 billion in cash from operating activities, C$1.9 billion in adjusted funds flow, and a robust free funds flow of C$897 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite challenges posed by Alberta wildfires and a planned turnaround at Foster Creek, the company’s total upstream production averaged 730,000 barrels of oil equivalent per day (BOE/d). Meanwhile, downstream throughput averaged 538,000 barrels per day (bbls/d), indicating a rising trend following the resumption of operations at the Superior and Toledo refineries.

The energy giant also announced significant returns to its shareholders, providing C$575 million via share repurchases and dividends while also purchasing and canceling 45.5 million warrants for C$711 million. However, not everything was positive in this report. The company’s updated guidance for the full year reflects an adjustment to its total production range, lowering it by 15,000 BOE/d to land between 775,000 BOE/d and 795,000 BOE/d.

Is Cenovus Energy Stock a Buy, According to Analysts?

According to analysts, Cenovus Energy stock has a Strong Buy consensus rating based on six Buys and two Holds assigned in the past three months. The average CVE stock price target of C$28.82 implies 16.8% upside potential.

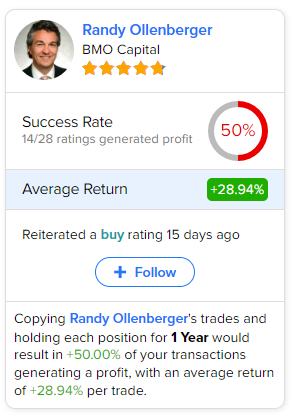

If you’re wondering which analyst you should follow if you want to buy and sell CVE stock, the most profitable analyst covering the stock (on a one-year timeframe) is Randy Ollenberger of BMO Capital, with an average return of 28.94% per rating and a 50% success rate. Click on the image below to learn more.