Cathie Wood, founder, and CEO of ARK Invest, surprised investors with her stock picks yet again. The expert hedge fund manager bought 839,301 shares of Zoom Video Communications (ZM), valuing approximately $68.25 million. On the contrary, ahead of chipmaker Nvidia’s (NVDA) results, Wood sold NVDA stock worth approximately $51 million.

Which ETF Holds the Most ZM Stock?

Wood’s flagship fund, ARK Innovation ETF (ARKK), bought 713,062 shares of Zoom. And ARK Next Generation Internet ETF (ARKW) bought 126,239 shares of ZM. Despite the slowdown in demand for Zoom’s offerings post-pandemic, the company has managed to consistently exceed earnings expectations since 2020.

Wood believes strongly in Zoom’s stock trajectory and has been consistently adding to its holdings. Wood’s ARK Innovation ETF (ARKK) is by far the largest holder of ZM stock. Zoom takes the number two spot (7.77%) in ARKK holdings and the number three spot (7.05%) in the ARKW fund.

Zoom posted mixed Q2FY23 results, missing revenue estimates but beating adjusted earnings forecasts. Moreover, the company’s lowered guidance fell short of analyst expectations, leading to a huge stock price fall of over 16%. Taking advantage of this plunge, Wood added ZM stock to ARKK and ARKW ETFs.

Cathie Wood Sells NVDA Stock

Wood’s ARK line of funds sold more than 293,661 shares of Nvidia on Tuesday, just a day ahead of its scheduled earnings. The ARKK fund sold NVDA stock worth $40 million and the ARKW fund sold NVDA stock worth $11 million. Wood’s prediction for Nvidia came true as the stock fell on dismal Q3FY23 guidance that fell short of expectations.

Remarkably, Cathie had bought 366,982 shares of Nvidia just two weeks before its earnings. Nvidia is not among the top ten holdings of the ARK line of funds.

Is Nvidia a Buy, Sell or Hold?

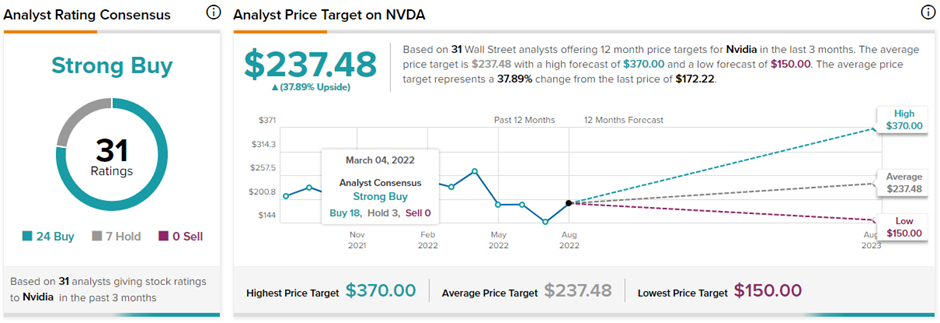

On TipRanks, NVDA stock commands a Strong Buy consensus rating. This is based on 24 Buys and seven Holds. The average Nvidia price forecast of $237.48 implies 37.9% upside potential to current levels. Meanwhile, the stock has lost 42.8% so far this year.

Ending Thoughts

Cathie Wood’s investment choices have often been questioned by the masses. Her solid belief in disruptive technology has won her both accolades and criticism. Yet again, adding Zoom’s stock to the ARK line of funds and selling Nvidia just a day before earnings have surprised the market. After turning in massive returns during the pandemic years, the ARK funds are down in 2022. Notably, the ARKK ETF is down 54.1% and the ARKW ETF is down nearly 55% so far this year.