Cathay General Bancorp (CATY), the holding company for Cathay Bank, recently announced a share repurchase program under which it will repurchase up to $125 million worth of its common stock. Following the news, shares of the company appreciated 1.6% to close at $39.79 on Friday.

The new share repurchase program comes hot on the heels of the $75,000,000 share repurchase program, which was announced on April 1, 2021, and completed on August 5, 2021, with the repurchase of 1,832,481 shares at an average cost of $40.93. (See Cathay General Bancorp stock chart on TipRanks)

Recently, Truist Financial analyst Brandon King reiterated a Hold rating on the stock. The analyst, however, raised the price target to $44 from $40, which implies upside potential of 10.6% from current levels.

According to the analyst, the company’s improving franchise volume coupled with a change in the funding mix towards core deposits gives it a strong footing. However, the analyst remains skeptical unless there is visibility of growth.

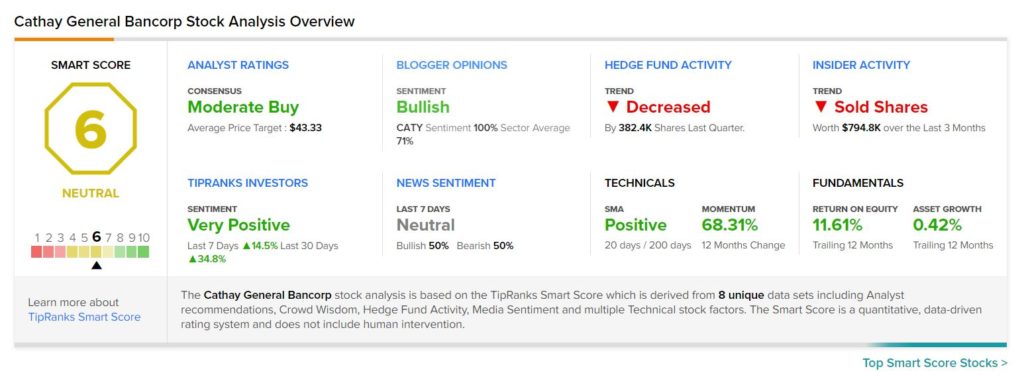

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 1 Buy and 2 Holds. The average Cathay General Bancorp price target of $43.33 implies that the stock has upside potential of 8.9% from current levels.

Cathay General Bancorp scores a 6 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations. Shares have gained about 66.7% over the past year.

Related News:

Nikola Strikes Fuel-Cell Manufacturing Deal with Bosch Group

Chevron, Bunge to Join Hands to Create Renewable Fuel Feedstocks

Donaldson Q4 Results Top Estimates; Issues Guidance