Construction and mining equipment manufacturer Caterpillar Inc. (NYSE: CAT) recently revealed that it has acquired an energy-as-a-service (EaaS) company, Tangent Energy Solutions. The financial terms of the deal have been kept under wraps.

Following the news, shares of the company declined 3% on Thursday. The stock, however, pared its losses slightly to close at $216.18 in the extended trading session.

The acquisition is expected to strengthen Caterpillar’s sustainable power capabilities with Tangent Energy’s proprietary turnkey software solutions.

Tangent Energy monitors patterns from grid and client facilities, looks for opportunities in energy markets, and then unleashes resources to increase returns without disrupting normal business operations.

Management Commentary

The Vice-President of Caterpillar Electric Power, Jason Kaiser, said, “Tangent Energy has developed a suite of intelligent energy solutions that leverages advanced analytics to provide value to customers. Tangent’s EaaS offerings complement Caterpillar’s broad portfolio of electric power products, enabling us to better serve customers for reliable, efficient, sustainable and connected power solutions that support business operations while generating new revenue streams.”

Stock Rating

Recently, Argus Research analyst John Eade reiterated a Buy rating on the stock with a price target of $235, which implies upside potential of 8.8% from current levels.

According to the analyst, valuation comfort, returning demand, strong balance sheet and regular dividends make Caterpillar an attractive choice for investors.

Consensus among analysts is a Strong Buy based on 10 Buys, one Hold and one Sell. CAT’s average price target of $247.42 implies upside potential of 14.6% from current levels. Shares have declined 8.9% over the past year.

Investors’ Stance

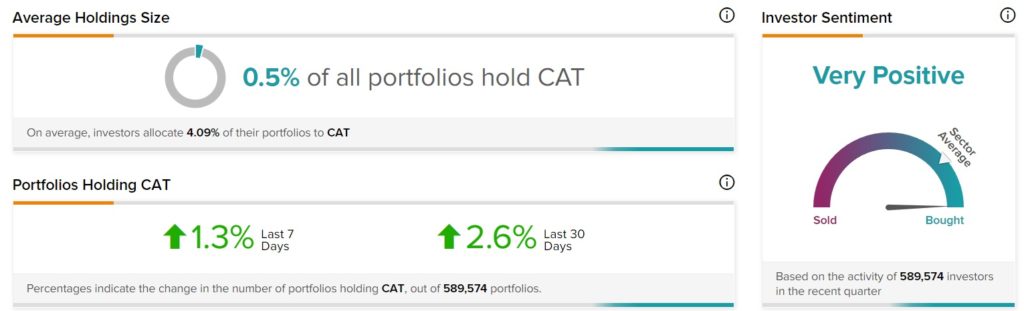

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on CAT, as 2.6% of portfolios tracked by TipRanks increased their exposure to CAT stock over the past 30 days.

Conclusion

With energy efficiency gaining prominence by the day, Caterpillar’s move to acquire a notable turnkey solutions provider seems to be a wise move that will further enhance the company’s clean energy capabilities.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Marriott Comforts Investors with Upbeat Q1 Results

Lockdown in China Leaves Yum! Brands With a Sour Taste

Etsy’s Muted Q2 Guidance Spooks Investors