Caterpillar (CAT) reported blowout Q2 results topping both earnings and revenue estimates driven by robust performances across all segments and regions. Despite the upbeat results, shares of the manufacturer of mining and construction equipment dropped 2.7% on Friday to close at $206.75.

Earnings of $2.56 per share more than trebled year-over-year and beat analysts’ expectations of $2.38 per share. The company reported earnings of $0.84 per share in the prior-year period. (See CAT stock charts on TipRanks)

Furthermore, revenues jumped 29% year-over-year to $12.9 billion and exceeded consensus estimates of $12.58 billion. The increase in revenues reflected a surge in sales volume boosted by increased end-user demand for equipment and services.

Notably, operating profit margin jumped 6,100 bps to 13.9% compared to 7.8% reported in the prior-year quarter.

The company reported higher manufacturing and material costs during the quarter, attributable to increased short-term incentive compensation expenses and higher labor-related costs.

However, the higher costs were partially offset by favorable cost absorption as a result of inventory increases during the second quarter of 2021 versus a decrease in inventory reported in the prior-year quarter.

Caterpillar Chairman and CEO Jim Umpleby commented, “Our dedicated global team remains focused on serving our customers, executing our strategy and investing for future profitable growth.”

Credit Suisse analyst Jamie Cook recently increased the price target on Caterpillar from $264 to $268 (29.6% upside potential) and reiterated a Buy rating.

Cook said, “Lead times on equipment extend through year-end. Parts availability is also a major issue. That being said, the competition is having similar issues, as such CAT doesn’t appear to be losing share. The housing market remains robust, including new builds and renovation work.”

He further added, “Infrastructure projects are also gaining strength as shelved projects have restarted, coupled with new project activity increasing. Non-residential trends remain mixed. Demand for rental equipment is robust again, constrained by lack of equipment.”

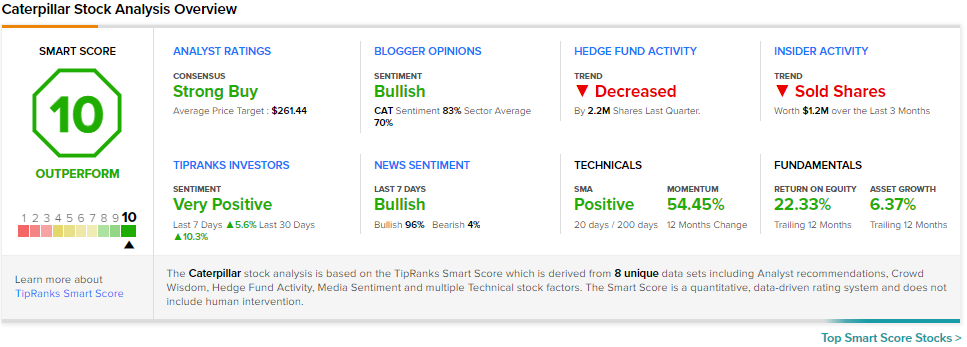

Consensus among analysts is a Strong Buy based on 7 Buys and 2 Holds. The average Caterpillar price target of $261.44 implies 26.5% upside potential to current levels.

CAT scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Twilio Inc. Posts Q2 Beat; Guidance Muted

Zendesk Misses Q2 Earnings Expectations; Shares Plunge 6.3%

Magellan Midstream Delivers Upbeat Results in Q2