In a challenging market environment, positive insider moves help shore up investor sentiment in a stock. This is exactly the case for biopharmaceutical company CASI Pharmaceuticals, Inc. (CASI), whose CEO just bought a sizable chunk of this penny stock.

CASI is focused on progressing its hematology-oncology therapeutic portfolio and aims to be a leader in the Greater China market. Its shares have dropped nearly 65% so far in 2022, and the company had to undertake a 1-for-10 reverse stock split on June 1 to remain compliant with NASDAQ’s minimum bid price requirement. As a result of this maneuver, the company now has about 13.61 million outstanding common shares and has a market capitalization of $40.5 million.

On Friday, CASI shares were up about 10% during the extended trading session after its Chairman, CEO, and Director, Wei-Wu He, acquired shares worth $272,500 in the company. The CEO has now bought CASI shares for the third time in the past 12 months and now has holdings worth $5.19 million in the company.

Most importantly, all of these Buys over the past 12 months were informative in nature, which indicates a positive insider confidence signal in the stock.

Analyst’s Take

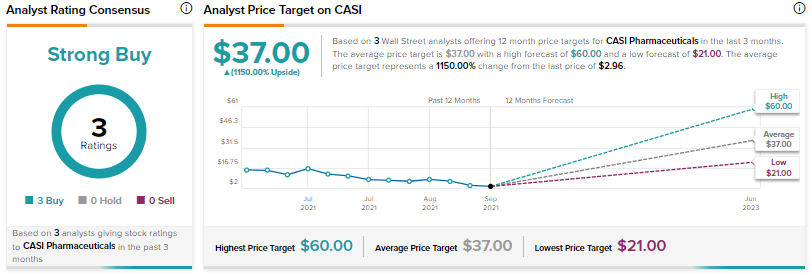

Concurrent to these insider moves, the Street remains more than optimistic about the stock with a Strong Buy consensus rating and a price target of $37, which implies a whopping 1150% upside potential.

Oppenheimer’s Leland Gershell has reiterated a Buy rating on the stock alongside a price target of $60. The analyst expects CASI to benefit from the reopening of Shanghai.

Closing Note

CASI may offer outsized returns to investors, in sync with the Street’s expectations. Although shares of the company have nosedived in 2022, it has been steadily improving its top line as well as the bottom line for a while now.

Revenue has increased from $4.13 million in 2019 to $30.17 million in 2021. The figure is expected to rise to $67.9 million in 2023. At the same time, the net loss per share is seen narrowing to $1.51 in 2023 from $4.80 in 2019.