Carnival Corporation reported a $2 billion net loss and projected a $550 million cash burn rate for the first half of 2021. However, Carnival’s cash burn rate came in better-than-expected at $500 million.

Carnival (CCL) ended the quarter with $11.5 billion of cash and short-term investments.

Chief Executive Officer, Arnold Donald, said, “We are focused on resuming operations as quickly as practical, while at the same time demonstrating prudent stewardship of capital and doing so in a way that serves the best interests of public health. Our highest responsibility and therefore our top priority is always compliance, environmental protection and the health, safety and well-being of everyone.”

The cruise ship company is hoping that nine ships across six of its core brands will resume operations this summer.

“Booking volumes are accelerating. During the first quarter of 2021 they were approximately 90% higher than volumes during the fourth quarter of 2020 reflecting both the significant pent up demand and long-term potential for cruising.” Donald stated.

Advanced bookings for 2022 are already more robust than the levels seen in 2019. Additionally, total customer deposits as of February were $2.2 billion, helping offset the impact of refunds provided.

Carnival will be pursuing refinancing opportunities to help reduce interest expense and extend maturities. The cruise ship company has also taken steps to minimize the monthly cash burn rate.

CCL plummeting in 2020, but shares have increased 30% since the start of the year. (See Carnival Corporation stock analysis on TipRanks)

Following the first-quarter report, Deutsche Bank’s analyst Chris Woronka increased the price target to $25 from $9, implying a 13.8% downside potential to current levels.

“Our $25 PT implies CCL can trade at 13.7x our 2023 adjusted EPS estimate relative to the five-year historical average EPS multiple of ~12.7x pre-pandemic. We believe this multiple is appropriate based on historical ranges,” Woronka stated in a research note.

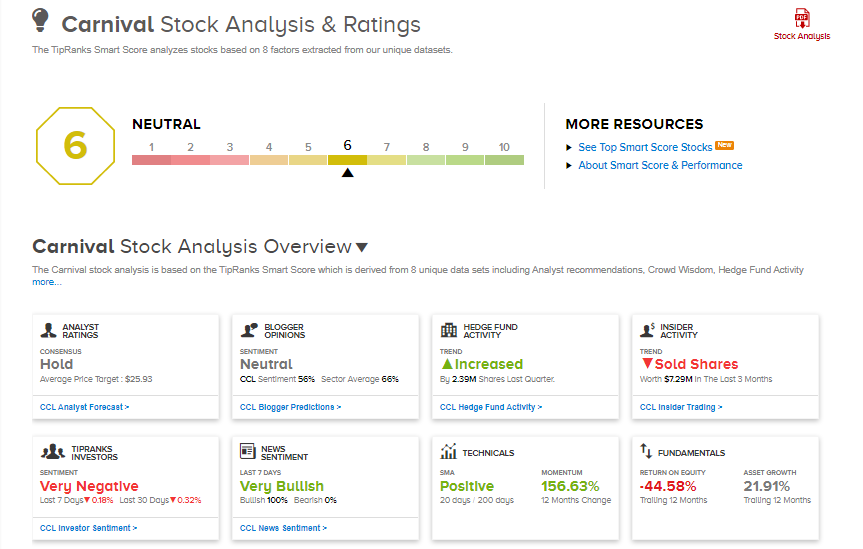

The consensus rating for CCL is a Hold based on 4 Buys, 4 Holds, and 4 Sells. The average analyst price target on the stock is $24.39, implying a 15.9% downside potential to current levels.

Based on TipRanks’ Smart Score rating system, CCL scores a 5 out of 10, signaling neutral prospects for the stock.

Related News:

MSC Industrial’s Revenues Fall Short Of Estimates In 2Q; Shares Drop 4.5%

Greenbrier Posts $9M Loss In 2Q; Shares Drop 7%

HTG Molecular Drops Over 7% As 1Q Revenue Forecast Lags Estimates