Automotive retailer America’s Car-Mart, Inc. (CRMT) delivered a robust set of numbers for the fourth quarter. Revenue jumped 26% over the prior-year period to $351.8 million, beating estimates by $41.7 million. Earnings per share of $4.01 outperformed consensus by $0.91.

During this period, while the number of operational stores increased by 2% to 154, the active customer count jumped 8% to 95,107. At the same time, while the number of retail units sold remained virtually constant at 16,426, the growth in the top line came from a 24.1% increase in the average retail sales price to $17,860.

Management Weighs In

Jeff Williams, President and CEO of CRMT, commented, “We are increasing market share while facing challenges stemming from ongoing supply and demand imbalances in the used car market, inflation, and declining consumer confidence. We expect to see additional productivity improvements as we leverage our investments and competitive strengths. Our most important opportunity is sourcing affordable, mechanically sound vehicles at sufficient quantities to support the high consumer demand for our offering.”

The company is focused on improving sales productivity to enable dealerships to support an average of 1,000 or more customers, up from the current average of 618 customers per dealership.

Analyst’s Take

Jefferies analyst John Hecht has reiterated a Hold rating on the stock while decreasing the price target to $89 from $115.

Overall, while the Street has a Moderate Sell consensus rating on the stock based on a Buy and a Hold each, the average CRMT price target of $106 still implies a 38.63% potential upside for the stock. That’s after a 27% slide in the share price so far in 2022.

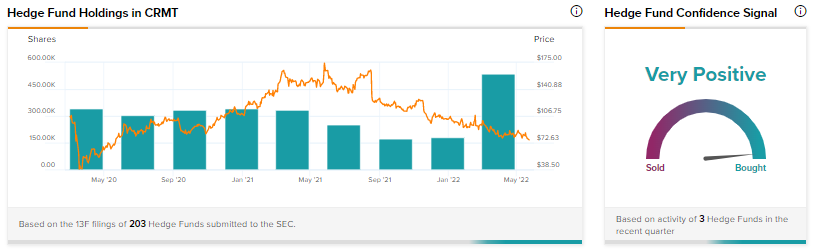

Hedge Funds Remain Positive About CRMT

TipRanks data shows hedge fund confidence signal in CRMT remains very positive based on activities of three funds in the recent quarter. Hedge funds have increased holdings in CRMT by 356,100 shares in the last quarter.

Closing Note

CRMT’s quarterly outperformance comes against the backdrop of a difficult macro environment. Gains in unit economics and a focus on serving more customers per dealership bode well for the stock in the coming periods.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

XPeng’s Q1 Results Fail to Produce Any Spark

Daniel Ives Tweets on Massive Tech Sell-Off & Musk’s Twitter Takeover

Zoom Delivers Q1 Earnings Beat; Street Sees 67% Upside