Shares of Canopy Growth (WEED) reported double-digit growth in sales and a profit in its first quarter of fiscal year 2022. The giant cannabis company sells a wide range of products including cannabis-infused beverages, edibles, dried flowers, and vapes.

Net revenue came in at C$136.2 million for Q1 2022, an increase of 23% from Q4 2021, thanks to double-digit growth in the Cannabis and other Consumer Products businesses. Analysts expected Canopy to post revenue of C$149 million for the quarter.

Meanwhile, net earnings for the quarter ended June 30, 2021, amounted to C$390 million, compared to a loss of C$128.3 million in the prior-year quarter. Canopy posted diluted earnings of C$0.84 per share in the first quarter, while it was expected to lose C$0.23. The company lost C$0.30 per diluted share a year ago. (See Canopy Growth stock charts on TipRanks)

Adjusted EBITDA loss in Q1 2022 dropped from C$93 million to C$64 million, thanks to lower operating expenses and higher sales.

The cannabis company remains committed to accelerating revenue growth in the second half of fiscal 2022 and achieving positive adjusted EBITDA by the end of fiscal 2022.

Canopy Growth CEO David Klein said, “With the right strategy and strong foundation in place we are confident in our ability to deliver long-term success as Canopy’s products and brands continue to demonstrate their appeal to consumers in our core markets.

“While we’re encouraged by regulatory advancement in the U.S., Canopy is not waiting as we continue to scale our business on both sides of the border with an exciting product pipeline planned for the coming quarters.”

Mike Lee, CFO, added that Canopy remains broadly on track to its target of C$150-200 million in cost savings in fiscal 2022-23.

Yesterday, MKM Partners analyst William Kirk reiterated a Buy rating on WEED with a C$51.00 price target. This implies 113.2% upside potential.

Kirk stated, “We believe Canopy has streamlined its organization (supply chain, logistics, infrastructure) to better seize once-missed opportunities. Canopy is better suited for building brands with a greater focus on R&D than its peers.”

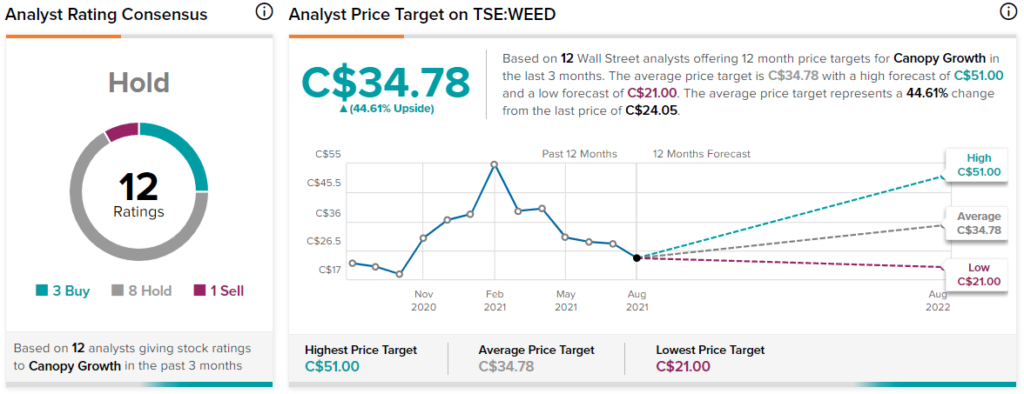

Overall, WEED scores a Hold rating among Wall Street analysts based on three Buys, eight Holds, and one Sell. The average Canopy Growth price target of C$34.78 implies 44.5% upside potential to current levels.

Related News:

High Tide Acquires DankStop for $3.85M

The Valens Signs Deal With Gallery Brands to Manufacture Edibles and Beverages

Canopy Growth Closes Acquisition of Supreme Cannabis