Canoo (GOEV) has secured an order to supply Walmart (WMT) with thousands of electric delivery vehicles. It plans to begin production of the vans that the retailer has ordered in Q4 2022, with Walmart hoping to start using the vehicles for online order deliveries in 2023. Canoo shares soared more than 53% to $3.63 on July 12. However, the stock is still down more than 55% year-to-date.

How Many Delivery Vehicles Is Walmart Buying from Canoo?

Walmart has initially ordered 4,500 vehicles from Canoo. It may purchase up to 10,000 vehicles in the long run. For the retailer, the deal with Canoo for the supply of electric delivery vehicles aligns with its goal to reduce its carbon footprint. Walmart aims to achieve zero-emissions by 2040.

The Canoo vehicles will join Walmart’s last-mile delivery fleet for online orders. Canoo plans to start advanced deliveries to Walmart in the coming weeks as part of a program to refine vehicle configuration. The Lifestyle Delivery Vehicle, the model that Walmart has ordered, is built for small package deliveries.

Canoo CEO, Tony Aquila, said, “Walmart’s massive store footprint provides a strategic advantage in today’s growing ‘Need it now’ mindset and an unmatched opportunity for growing EV demand, especially at today’s gas prices.”

Deal Struck After Canoo Moves HQ to Walmart’s Hometown

In 2021, Canoo decided to set up its headquarters in Bentonville, Arkansas, where Walmart is also headquartered. Canoo said its deal with Walmart builds on its commitments in Arkansas. The company has its manufacturing site in Pryor, Oklahoma.

David Guggina, Walmart’s U.S. Senior Vice President of Innovation and Automation, said, “We’re encouraged that by being located in close proximity to the Canoo headquarters, we have the advantage to collaborate and innovate in real-time as well as the opportunity to aid in the creation of manufacturing and technology jobs here in our home state of Arkansas.”

Wall Street’s Take on Canoo

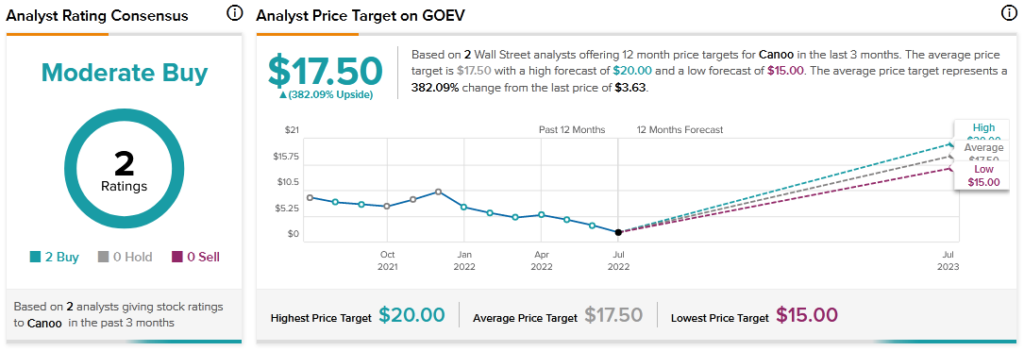

The Street is cautiously optimistic about Canoo stock with a Moderate Buy consensus rating, based on two Buys. The average Canoo price target of $17.50 implies 382% upside potential to current levels.

GOEV’s Smart Score

Canoo scores an eight out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Key Takeaway for Investors

Auto manufacturing can be a capital-intensive operation, and funding shortages can result in product delays that could in turn hurt sales. Canoo seems to have its act together as it gets down to fulfilling Walmart’s order.

The company finished Q1 with $104.9 million in cash and access to $600 million in capital to support the start of production. However, it is unclear whether the funds will be sufficient to complete the Walmart order and others, or whether the company will need to raise more money.

Read the full Disclosure