Shares of Canadian Tire (CTC.A), a general merchandise retailer selling gasoline, automobiles, sports, and home products, fell in early trading Thursday after the company missed expectations in the third quarter of 2021.

Consumers spent less on indoor supplies and home furnishings over the summer. (See Analysts’ Top Stocks on TipRanks)

Revenue & Earnings

Revenue for Q3 2021 came in at C$3.91 billion, down 1.8% from C$3.99 billion in Q3 2020. E-commerce sales were C$257.3 million in the quarter, down 2.2% from the prior-year quarter. Consolidated comparable sales were up 3.3% year-over-year.

Canadian Tire reported a net income attributable to shareholders of C$243.7 million (C$3.97 per diluted share) in Q3 2021, a decrease of 17.8% from C$296.3 million (C$4.84 per diluted share) in Q3 2020.

On a normalized basis, the retailer earned C$4.20 per share in the quarter, down from a normalized profit of C$4.93 per share in the same period a year ago. Analysts on average expected adjusted earnings of C$4.30 per share and C$3.97 billion in revenue.

Dividend Hike, Share Repurchase Plan

Canadian Tire president and CEO Greg Hicks said, “I am proud of the work the team has delivered to achieve our previously committed operating efficiency target of C$200+ million in annualized savings ahead of schedule, as we continue to prove our ability to transform our Company and invest to modernize our business.

“We see the path to an additional C$100 million in savings through 2022. Our confidence in the Company’s future is evidenced by the significant increase in our dividend and the reinstatement of our share repurchase program, which will see us repurchase up to C$400 million by the end of 2022.”

The company increased its annual dividend by 10.6% to C$5.20 per share, marking 12 years of dividend increases.

Wall Street’s Take

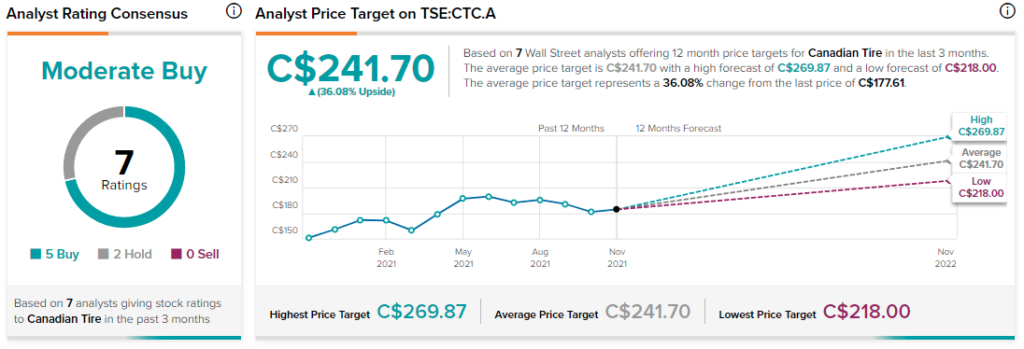

On November 2, Canaccord analyst Luke Hannan reiterated a Hold rating on CTC.A while lowering its price target to C$218 (from C$220). This implies 22.7% upside potential.

Overall, CTC.A scores a Moderate Buy consensus rating among analysts based on five Buys and two Holds. The average Canadian Tire price target of C$241.70 implies 36.1% upside potential to current levels.

Related News:

Thomson Reuters Q3 Revenue Rises; Shares Pop

Shopify Q3 Revenue and Profit Miss Estimates

Restaurant Brands Q3 Revenue Rises 12%; Shares Plunge