Shares of Canada Goose Holdings Inc (GOOS) fell more than 7% in early trading Thursday despite the company posting record revenue in its fourth quarter, driven by online sales and strong store performance in China. Based in Toronto, Canada Goose is one of the world’s largest extreme weather outerwear retailers.

Canada Goose’s revenue for Q4 2021 came in at C$208.8 million, an increase of 48% versus the prior-year quarter. Revenue in the Canadian market decreased 6.9% as many stores in Canada were forced to close. Six out of 28 stores are still closed. The company’s global online revenue more than doubled, increasing 123.2% in the quarter.

Both direct-to-consumer (DTC) sales and wholesale revenue increased in the quarter. DTC revenue rose 50.8% to C$172.2 million, driven by e-commerce growth and continued store expansion in mainland China. The revenue increase was partially offset by lower store revenues in other markets. Wholesale revenues increased 33.2% to C$33.3 million thanks to higher in-season orders.

Meanwhile, net income amounted to C$2.9 million (C$0.03 per share), up from C$2.5 million (C$0.02 per share) in the fourth quarter of 2020.

Canada Goose’s President and CEO Dani Reiss said, “Canada Goose has shifted from recovery to growth beyond pre-pandemic levels. We achieved our largest ever fourth quarter by revenue. With triple-digit e-Commerce growth and a resilient retail performance despite disruptions, we served our global consumer base through agile and flexible DTC distribution. Our new Cypress and Crofton collection, as well as the NBA All-Star collaboration, also showcase our ability to relentlessly drive brand heat. Recognizing pandemic uncertainties remain, we are highly confident in our potential for meaningful growth as we move into fiscal 2022.”

For Fiscal Year 2022, Canada Goose expects total revenue to exceed C$1 billion. (See Canada Goose Holdings Inc stock analysis on TipRanks)

Earlier this week, UBS analyst Jay Sole reiterated a Buy rating on GOOS while raising its price target to $55.00 (C$66.65) for 37.6% upside potential.

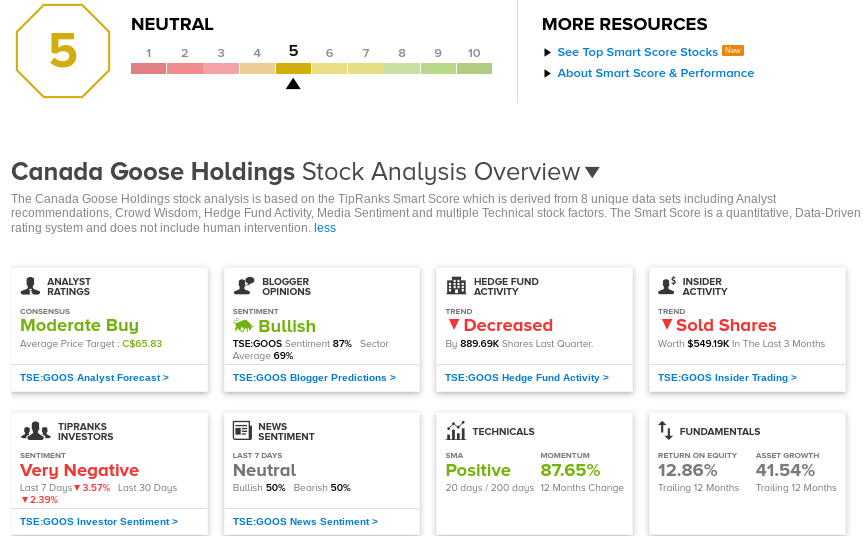

The rest of the Street is cautiously optimistic on GOOS with a Moderate Buy consensus rating, based on 2 Buys. The average analyst price target of C$65.83 implies upside potential of 36% from current levels. Shares have risen by approximately 25% year-to-date.

TipRanks’ Smart Score

GOOS scores a 5 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock’s returns are likely to perform in line with the market.

Related News:

Aritzia 4Q E-Commerce Revenue Increases 81%

Rritual Superfoods Teams Up With Ultimate Sales Canada

Spin Master Delivers Strong Revenue And Profit Growth In 1Q; Shares Pop 10%