Shares of California Resources Corporation (CRC) gained 2.4% on November 11 to close at $45.37 after the company reported stronger-than-expected third-quarter results. Meanwhile, the independent oil and natural gas company initiated dividends and updated its FY2021 guidance.

Impressive EPS Beat

Adjusted earnings of $1.83 per share exceeded analysts’ expectations of $0.70 per share. The company had reported earnings of $1.68 per share in the prior-year period. (See California Resources stock charts on TipRanks)

Revenues jumped 44% year-over-year to $588 million against consensus estimates of $483.6 million.

During the quarter, the company produced an average of 102,000 net barrels of oil equivalent (BOE) per day, including 62,000 barrels per day of oil.

Inaugural Quarterly Dividend of $0.17 per share

Meanwhile, the company announced an inaugural quarterly dividend of $0.17 per share, which is payable in the fourth quarter. The total outlay amounts to $14 million, and the future dividend payments will be subject to Board approval.

Further, under a share repurchase program, the company bought back 3.1 million shares for $104 million through November 5, 2021, at an average share price of $33.99 per share.

Updated Guidance

For full-year 2021, the company forecasts per day production in the range of 99 MBOE to 101 MBOE, up from the prior guided range of 97 MBOE to 100 MBOE per day.

The company anticipates adjusted EBITDA in the range of $840 million to $900 million against the prior guidance of $725 million to $825 million.

See Insiders’ Hot Stocks on TipRanks >>

Management Weighs In

The CEO of CRC, Mac McFarland, said, “Given the strength of our 2021 drilling program and the current commodity environment, we added a fourth rig in Buena Vista Shale in October. Additionally, we expect to have more than $325 million of cash on hand at year end after share repurchases and a cash dividend payment.”

McFarland added, “As we continue to make progress on our ESG strategy, we are excited to announce a 2045 Full-Scope Net Zero Goal which targets Scope 1, Scope 2 and Scope 3 emissions.”

Wall Street’s Take

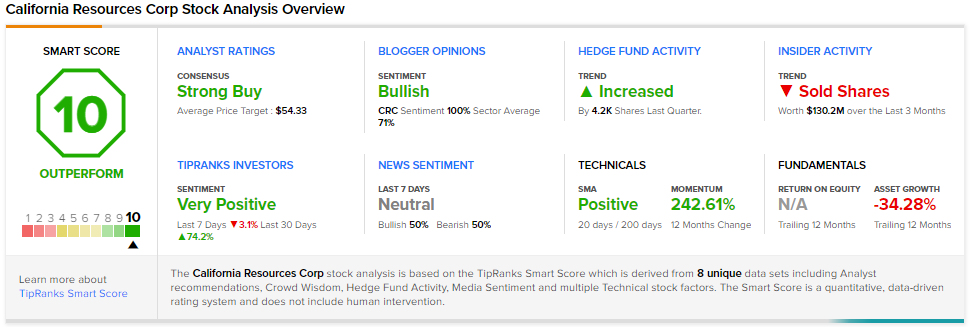

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average California Resources price target of $54.33 implies 19.75% upside potential to current levels.

CRC scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

DoorDash Up 19% on Wolt Acquisition and Q3 Revenue Beat

Repay Holdings Outperforms in Q3

Senseonics Holdings Exceeds Q3 Earnings Expectations