CACI International Inc (CACI) inked a deal to acquire SA Photonics, Inc. for $275 million. Through this deal, the company aims to expand its photonics technology and enhance next-generation laser communication for the U.S. government and other commercial missions.

CACI provides services to several departments of the U.S. Federal Government, including Healthcare, Intelligence, Homeland Security and Defense. (See Caci stock chart on TipRanks)

California-based SA Photonics, Inc., is a leader in the development of innovative multi-domain photonics technologies for free-space optical (FSO) communications. It provides low size, weight, power, and cost solutions that transmit data 25 times faster than current radio frequency systems.

The addition of SA Photonics will enhance CACI’s capabilities, and expand its development and manufacturing capacity in the U.S. Furthermore, its high-volume low-earth-orbit (LEO) optical inter-satellite links (OISL) technology will complement CACI’s FSO technology.

CACI CEO John Mengucci commented, “For two decades, CACI has successfully delivered FSO communications to advance evolutionary technology for the protection and exploration of the contested space domain.”

He further added, “Our innovative space-based photonics technology delivers enhanced capability for missions ranging from national security to human spaceflight. With SA Photonics, our combined technology enables us to deliver immediate FSO communications across all-domains.”

The acquisition is expected to be closed by the end of the calendar year, subject to certain regulatory approvals.

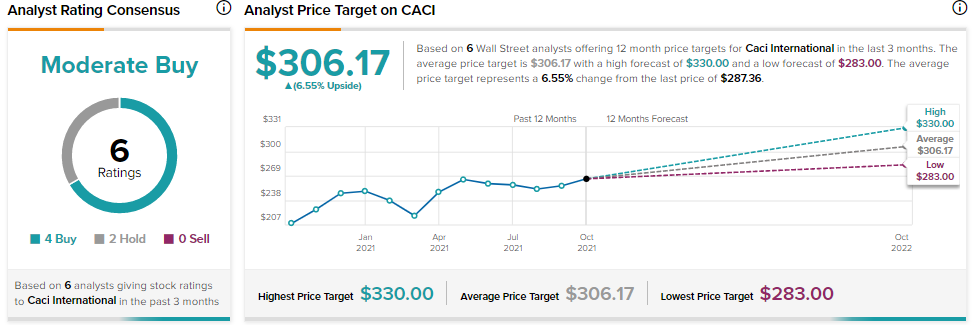

Following the company’s earnings announcement recently, Wells Fargo analyst Matthew Akers increased the price target on CACI to $330 (15.5% upside potential) from $300, while maintaining a Buy rating.

Akers stated that CACI’s Q1 growth of 2% was not outstanding but met the prior guidance. Furthermore, despite softness in civil contracts data, CACI hasn’t witnessed any COVID-related softness for contracts.

He added, “CACI has almost achieved 90% of employees’ vaccinations. Though the government vaccine mandate is a possible risk, it is already factored into the guidance.”

Overall, the stock has a Moderate Buy consensus based on 4 Buys and 2 Holds. At the time of writing, the average CACI International price target was $306.17, which implies nearly 6.55% upside potential.

Related News:

McKesson Posts Stellar Q2 Results; Shares Up 3%

Beacon Acquires Midway; Shares Up 2.1%

Transocean Posts Weak Q3 Results; Shares Down 4.3%