Caci International announced an accelerated share repurchase (ASR) plan of $500 million, which represents about 2.1 million shares. The information solutions and services provider closed over 2% higher on Friday.

Per the ASR program, Caci (CACI) said that it will receive an initial delivery of about 1.7 million shares on March 16. The company expects the repurchases to close before the fourth quarter of 2021.

Caci’s CEO John Mengucci said, “This accelerated share repurchase transaction is the next step in a more opportunistic and flexible capital deployment strategy and demonstrates our confidence in CACI’s strategy and future growth prospects.” (See Caci International stock analysis on TipRanks)

Following the share buyback announcement, Raymond James analyst Brian Gesuale maintained a Hold rating on the stock. In a note to investors, the analyst said that the ASR “reflects management’s confidence in FCF [free cash flow] momentum, contract visibility, and liquidity.” The analyst added that “we expect today’s announcement to alleviate pressure that has been facing the stock.”

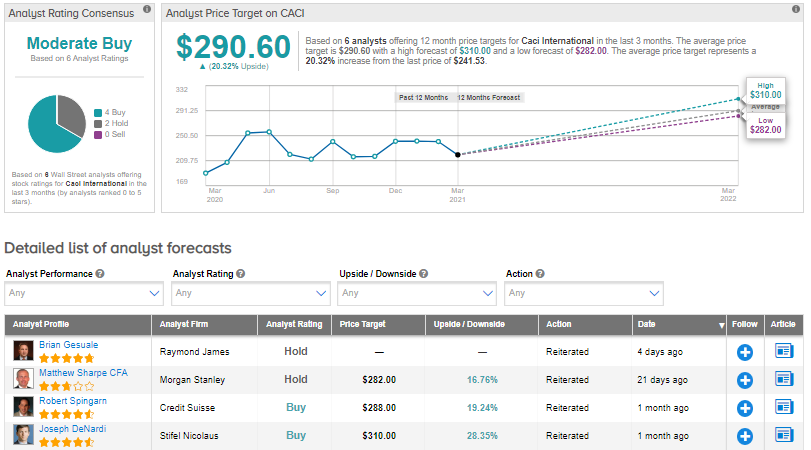

Overall, consensus among analysts is a Moderate Buy based on 4 Buys and 2 Holds. The average analyst price target of $290.60 implies upside potential of about 20.3% to current levels. Shares have gained around 10% over the past year.

Related News:

U.S. Steel Lifts 1Q Profit Guidance On Strong Demand

Four Corners Buys Caliber Collision Property For $1.9M

AT&T Lifts HBO Subscribers Growth Forecast, Mulls International Expansion