Shares of Burberry Group (BURBY) tanked 2.5% on Wednesday after it reported an earnings miss for the Fiscal Year 2022 (ended April 2, 2022). The company manufactures, designs and distributes apparel and accessories under the Burberry brand.

Earnings came in at £0.94 per share ($0.75), which lagged the consensus estimate of $0.76 per share. However, the figure compares favorably with the earnings of £0.67 per share reported in the same quarter last year.

Burberry reported revenues of £2.83 billion, up 20.6% year-over-year. The upside can be attributed to a 19% increase in the company’s Retail revenue. Meanwhile, Wholesale and Licensing revenues climbed 29% and 8%, respectively.

The CEO of Burberry, Jonathan Akeroyd, said, “The company has made great progress over the last five years to elevate the brand, product and customer experience into the luxury space. I look forward to setting out my plans for building on these strong foundations and accelerating growth at the interim results in November.”

Outlook

Burberry expects revenue in the Fiscal Year 2023 to grow in the high single-digit. Based on May 6 spot rates, the company expects a currency tailwind of £159 million on revenue and £92 million on adjusted operating profit.

However, the guidance depends on the impact of COVID-19 and the rate of recovery in consumer spending in Mainland China. “While the current macro-economic environment creates some near-term uncertainty, we are actively managing the headwind from inflation,” the company added.

Bloggers’ Take

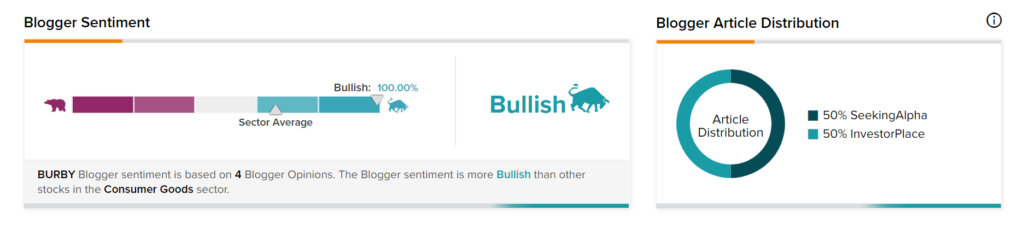

TipRanks data shows that financial blogger opinions are 100% Bullish on BURBY, compared to a sector average of 66%.

Takeaway

While Burberry expects revenues to be impacted in Fiscal 2023, it also sees year-over-year growth. Further, its focus on strengthening digital channels bodes well for the company.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Insiders Buying Drive Shack: Should You Follow Too?

Ross Gerber’s Tweet Signals Real Estate Sector’s Collapse

Argo Blockchain’s Q1 Revenues Improve on Higher Hash Rate