British American Tobacco disclosed on Wednesday that it now expects adjusted revenue growth in 2020 to be at the high end of its previous forecast as the Covid-19 pandemic-led headwinds are poised to be more limited than previously feared.

Specifically, British American Tobacco (GB:BATS) said that it projects 2020 revenue growth to be at the high end of its 1% to 3% range forecast. In a business update on the second half of 2020, the cigarette maker reported that it now expects the Covid-19 headwind impact on sales to be about 2.5%, down from the 3% it had forecasted previously. Meanwhile, the maker of Lucky Strike cigarette brand maintained its adjusted EPS guidance.

“We are transforming our business. BAT encourages those who would otherwise continue to smoke to switch completely to scientifically substantiated reduced risk alternatives,” BAT CEO Jack Bowles said. “We are growing our New Category business as fast as possible and we are proud to now have around 13 million non-combustible product consumers. We are continuing to increase investment in our three New Categories of potentially reduced risk cigarette alternatives, capitalising on our momentum, while continuing to deliver on our financial commitments.”

Bowles reaffirmed the company’s commitment to boost its new category business with a target of generating £5 billion in revenue by 2025. The new category business includes vapour brand vype and tobacco heating product glo. In addition, BAT said it expects spending on new categories to increase by £200 million in the second half of 2020, as the company capitalizes on investment opportunities.

Furthermore, the cigarette-maker plans for a dividend pay-out ratio of 65% of adjusted diluted EPS and growth in sterling terms, supported by a strong liquidity position, it said. (See BATS stock analysis on TipRanks)

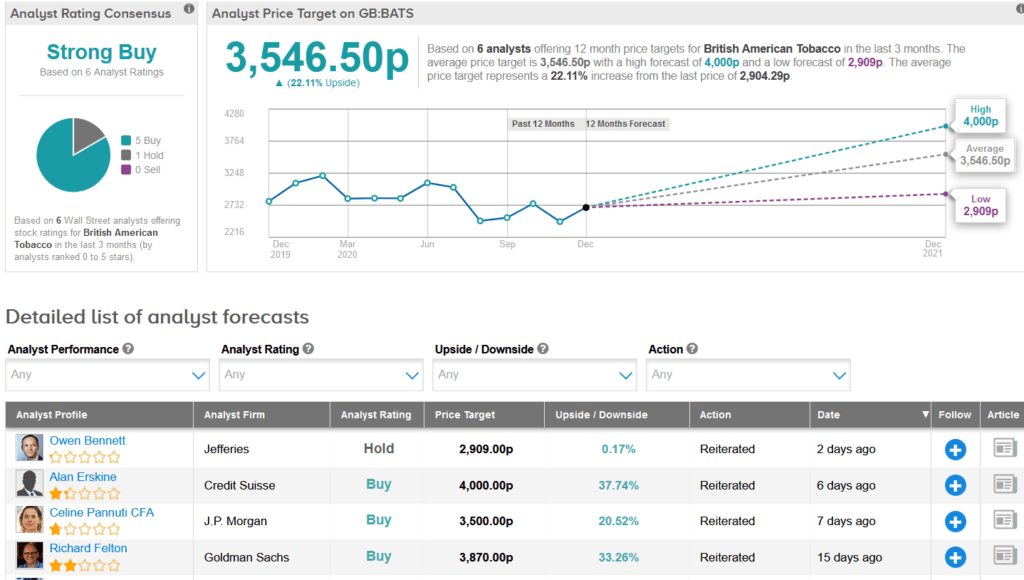

From the Street, the stock scores a Strong Buy analyst consensus based on 5 Buys versus only 1 Hold rating. With shares down 10% so far this year, the average analyst price target stands at 3,546.50p and implies 22% upside potential lies ahead over the coming year.

Related News:

G-III Apparel Tops 3Q Estimates; Street Sticks To Hold

GameStop Sinks 17% As 3Q Sales Disappoint; Street Sees 54% Downside

Chewy Posts Lower-Than-Feared 3Q Loss; Stock Up 173% YTD