Shares of pharmaceutical major Bristol Myers Squibb (BMY) have climbed 9.5% so far this year. BMY’s recent fourth-quarter numbers were a mixed bag, with its bottom-line coming in ahead of estimates.

Higher Eliquis sales helped BMY’s Q4 revenue increase 8% year-over-year to $12 billion. Nonetheless, the figure lagged estimates of $12.12 billion. Earnings per share, on the other hand, rose 25% over the prior year, beating estimates of $1.82.

Additionally, on February 14, BMY announced two-year follow-up results from its Phase 3 CkeckMate -9ER trial. The results showed that the combination of Opdivo and CABOMETYX versus sunitinib demonstrated sustained survival and response rate benefits, and quality of life improvements in patients, with first-line treatment of advanced renal cell carcinoma (RCC).

With these developments in mind, let us take a look at the changes in BMY’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, BMY’s top risk category is Finance & Corporate, contributing 7 of the total 27 risks identified for the stock, compared to a sector average of 16 risk factors under the same category.

In its recent report, the company has added one key risk factor under the Ability to Sell risk category.

BMY highlighted that its future growth hinges on access to markets, growth in its marketed brands, new product launches, product extensions, and co-promotional activities with partners. Competition in the market is heightening and as BMY loses patent exclusivity, generics will achieve market penetration.

Additionally, in countries where patent protection is weaker, or due to the promotion of generics and biosimilars, BMY may lose market share. Consequently, if the company is not able to compete against competitors’ products, then its revenue and earnings may suffer.

Hedge Fund Activity

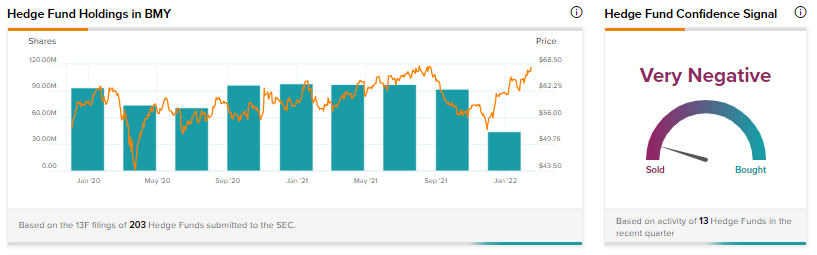

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in Bristol Myers Squibb by 48 million shares in the last quarter, indicating a very negative hedge fund confidence signal in the stock based on activities of 13 hedge funds. Notably, Ken Fisher’s Fisher Asset Management has a holding worth about $27.6 million in BMY.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Neurocrine Biosciences Up 7.5% Despite Q4 Miss

Mr. Cooper Group Gains 19% on Q4 Earnings Beat & New Partnership

Green Plains Tanks 9% on Wider-Than-Expected Q4 Loss