BrightView Holdings, Inc. (BV) offers commercial landscaping services, which include landscape maintenance and enhancements, tree care, and landscape development.

Yesterday, BrightView announced the acquisition of Performance Landscapes, a Honolulu-headquartered commercial landscaping company. Terms of the transaction were not disclosed by BrightView.

BrightView is expected to report first-quarter earnings on February 10. Analysts see the company delivering earnings per share of $0.11 as compared to the year-ago figure of $0.12.

With these developments in mind, let us take a look at the changes in BrightView’s key risk factors that investors should know.

Risk Factors

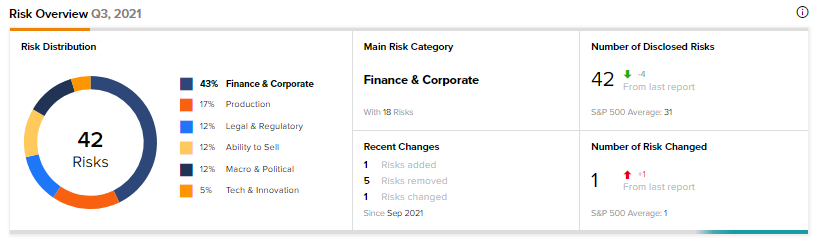

According to the TipRanks Risk Factors tool, BrightView’s top risk category is Finance & Corporate, contributing 43% to the total 42 risks identified.

In its recent annual report, the company has added one key risk factor under the Legal & Regulatory risk category. Compared to a sector average of 24%, BrightView’s Legal & Regulatory risk factor is at 12%.

BrightView highlighted that KKR BrightView L.P. and MSD Partners beneficially own 48.1% and 11.2% of BrightView’s common shares, respectively. Consequently, these companies can exert substantial influence over BrightView. The risk remains that their interests may not align with BrightView or its investors in all cases.

Wall Street’s Take

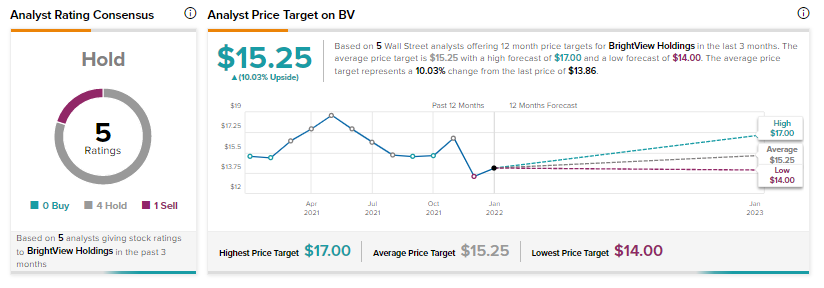

Wall Street’s top analysts have a Hold Consensus rating on BrightView based on 4 Holds and 1 Sell. The average BrightView price target of $15.25 implies a potential upside of 10%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Coinbase & Mastercard Collaborate to Simplify NFT Purchases

Hotel Chocolat Q2 Revenue Rises 37%

Truist Financial Posts Better-Than-Expected Q4 Earnings