Box announced better-than-expected 2Q results fueled by strong cloud storage demand amid the pandemic-led shift to remote working. The cloud storage solution provider’s shares rose 8.8% in the extended trading session on Wednesday.

Box (BOX) reported 2Q revenues increased 11% to $192.3 million year-on-year, surpassing analysts’ expectations of $189.6 million. Adjusted EPS of $0.18 beat Street estimates of $0.12 during the reported quarter.

Buoyed by strong quarterly performance, Box now anticipates fiscal 2021 revenue between $767 million and $770 million, up from a previous forecast of $760-$768 million. The non-GAAP EPS guidance range was lifted to $0.56-$060 from $0.47-$0.52. (See BOX stock analysis on TipRanks).

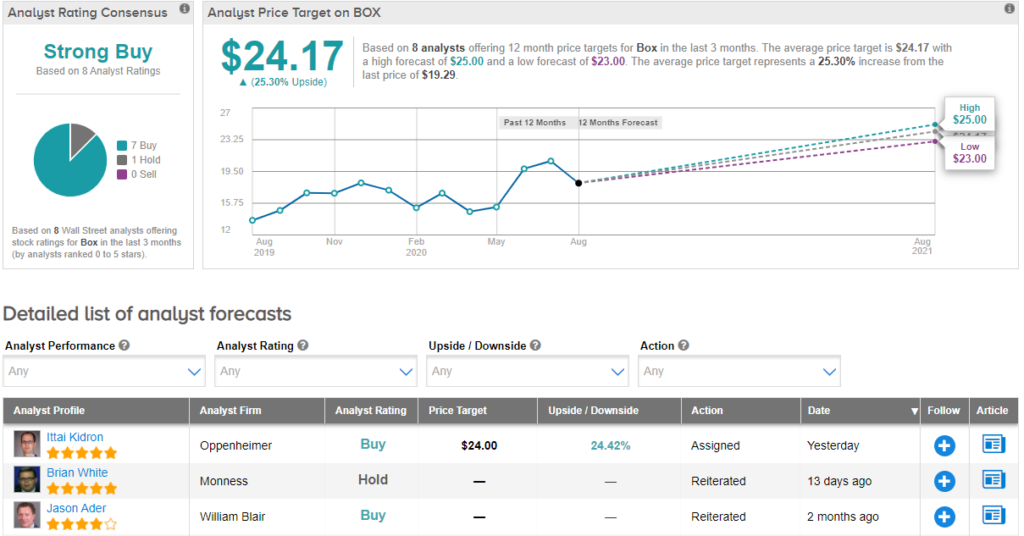

Following 2Q results, Oppenheimer analyst Ittai Kidron said that “we believe Box is better-positioned to capitalize on its increased relevance with larger enterprises (WFH activity) and see expansion/large deal activity improving as Suites/new product adoption gains more momentum.” Kidron maintains a Buy rating on the stock with a price target of $24 (24.4% upside potential).

Currently, BOX has a Strong Buy analyst consensus. With shares up already 15% year-to-date, the average price target of $24.17 implies upside potential of another 25.3%.

Related News:

Salesforce Spikes 13% In After-Hours On Lifted Sales Guidance

BMO Lowers Palo Alto’s PT After 4Q Beats Estimates

Intuit Soars 6% In After-Hours On Strong 4Q Results