Shares of Boston Beer closed 19% higher on Friday after the brewer’s 3Q earnings blew past analysts’ estimates. The company’s 3Q EPS surged 78.4% to $6.51 year-over-year, surpassing the Street consensus of $4.63 fueled by robust revenue growth.

Boston Beer’s (SAM) 3Q revenues (less of excise taxes) jumped 30.2% year-over-year to $492.8 million, reflecting strong growth in Truly Hard Seltzer and Twisted Tea brands. However, sales fell short of the Street’s estimates of $519 million as weakness in Samuel Adams, Angry Orchard and Dogfish Head brands remained a drag.

The company witnessed shipment growth of 30.5% in 3Q. Depletions increased 36%, reflecting “key innovations, quality and strong brands, as well as sales execution and support from our distributors,” the company said.

For 2020, Boston Beer expects earnings in the range of $14-$15 per share, higher than its previous forecast of $11.7-$12.7 per share. Analysts had expected 2020 earnings of $14.95 per share. The company forecasts 2020 shipments and depletions growth to be between 37%-42%, up from the earlier guidance range of 27%-35%. (See SAM stock analysis on TipRanks).

Boston Beer’s CEO Dave Burwick said “The growth of the Truly brand, led by Truly Lemonade Hard Seltzer, continues to be very strong and we expect the Truly brand to continue to lead the growth of the business into 2021.” Burwick also said that “We will continue to invest heavily in the Truly brand and work to improve our position in the hard seltzer category as competition continues to increase.”

Further, the brewer expects all of its brands to “grow in 2021” and is “targeting overall volume growth rates to be between 35% and 45%.” In addition, the company is also planning to launch many versions of Truly brand in the hard seltzer category in 2021.

Following the results, MKM Partners analyst William Kirk maintained a Hold rating on the stock with a price target of $780 (28.5% downside potential), as he does not expect “Boston Beer’s growth rate to accelerate.” Kirk said that “Boston Beer is effectively guiding to more 2021 growth (35% to 45%) than they just delivered in 3Q (36%). Not only do prior-year comparisons get more difficult, but hard seltzer, Boston’s primary growth driver also continues to slow into SAM’s 4Q’20.” He added that “While the company has an incredible track record of innovation, we believe these forecasts are too optimistic.”

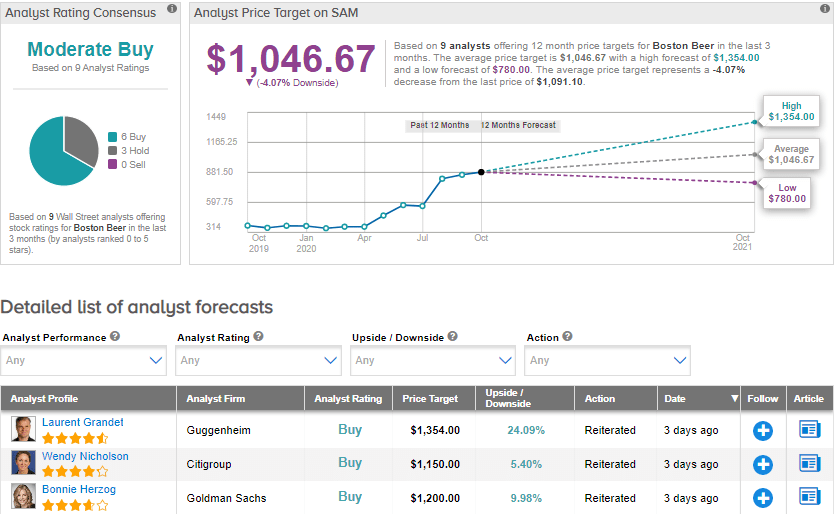

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys and 3 Holds. With shares already down 188.8% year-to-date, the average price target of $1,046.67 implies downside potential of another 4.1% to current levels.

Related News:

Autoliv’s 3Q Earnings Rise As Demand Picks Up; Street Says Hold

Illinois Tool Gains On 3Q Sales Beat; Analyst Sticks To Hold

Kimberly Clark Sinks 7% On 3Q Earnings Miss