Borr Drilling updated investors that it has been working actively with its creditors on a plan to bolster its cash buffers by $925 million over the next two years. Shares gained 1.4% at after-hours trading on Thursday.

Specifically, Borr Drilling (BORR) said that it has now secured support from its creditors for the two-year $925 million liquidity improvement plan, subject to the company successfully raising $40 million in new equity.

The company is working on the terms and conditions towards the closure of the new equity issue expected by the end of 2021. Borr Drilling said that it has already received strong support from its main shareholders towards for the new equity issue.

“Borr Drilling is very thankful for the support given by all the secured creditors and yards to strengthen the financial footing of the company. We consider this a great testimony to the quality of our people, assets, and operations who in turn deliver value to our customers”, said Borr Drilling CEO Patrick Schorn.

Shares of the drilling company have been hit hard and have lost 90% this year. (See BORR stock analysis on TipRanks)

On Nov. 30, Borr Drilling reported that its revenue declined by 42.4% to $59.2 million, missing analysts’ estimates by $24.58 million. The company’s Q3 net loss per share rose by 48% to $0.39, lagging the Street consensus by $0.08. The company said the revenue decline was impacted by a reduced number of active rigs due to contract cancellations and suspensions by operators, as well as pandemic-led costs.

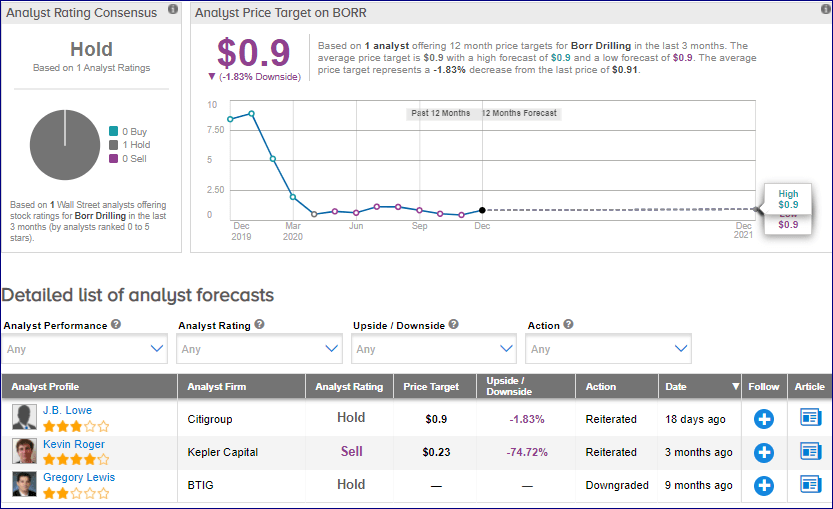

Following the earnings release, Citigroup analyst J.B. Lowe reiterated a Hold rating on the stock, but lowered the price target from $1.10 to $0.9 (downside potential of 1.8%).

Related News:

TechTarget Closes BrightTALK Acquisition; Top Analyst Lifts PT

IBM Settles Patent Lawsuit With Airbnb; Street Sees 16% Upside

Entergy, Holtec File Transfer Request For Palisades Nuclear Plant; Street Sees 21% Upside