U.K.-based airline holding company International Consolidated Airlines Group SA (GB: IAG) has ordered 50 of Boeing Co.’s (NYSE: BA) 737 MAX aircraft, a report published by The Wall Street Journal said.

As per the terms of the deal, IAG has the option to order 100 more of these aircraft. The deal includes Boeing’s 737-8200 and MAX 737-10 planes, which are expected to be delivered between 2023 and 2027. The 737-10 is the biggest version of the MAX plane, but it is yet to receive the Federal Aviation Administration’s (FAA) approval.

The order forms a part of a letter of intent signed by IAG’s former CEO Willie Walsh in June 2019 to buy 200 MAX jets from Boeing.

IAG owns Spain’s Iberia, Ireland’s Aer Lingus and British Airways. The holding company plans to use Boeing’s aircraft to renew the fleet of its airline subsidiaries.

Wall Street Weighs In

After the news was released, Morgan Stanley (NYSE: MS) analyst Kristine Liwag reiterated a Buy rating on the stock with a $215 price target (69.1% upside potential).

The analyst said, “We view it positively that BA continues to take in orders and see continued demand for new aircraft as a positive for Boeing and the supply chain.”

Overall, the stock has a Strong Buy consensus rating based on 15 Buys and four Holds. BA’s average price target of $221.94 implies 74.6% upside potential. Shares have lost 44.2% over the past year.

Bloggers’ Stance

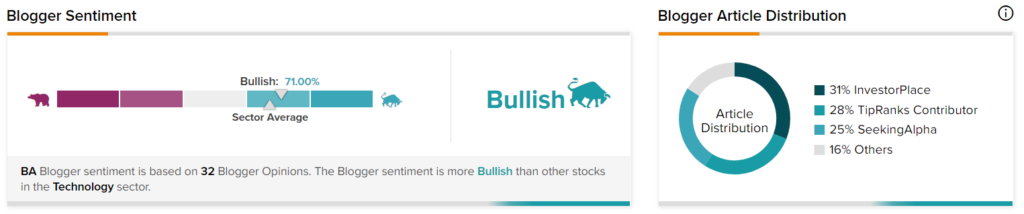

TipRanks data shows that financial blogger opinions are 71% Bullish on BA, compared to the sector average of 67%.

Conclusion

Following the announcement, BA stock gained 1.3% on Thursday. It went up another 0.7% in the extended trading session to close at $127.14. Even though IAG’s order is smaller than planned, it comes as a major boost for Boeing.

The Chicago-based aerospace company has also been facing fierce competition from Airbus (EADSF) over new orders for short-haul flights.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Synopsys Stock Gets Wings after Impressive Q2 Performance

Burberry’s Fiscal 2023 Outlook Fails to Delight Investors

KKR Bolsters KKR Ascendant with Investment in Alchemer