Aerospace stock Boeing (BA) seems to be turning things around lately, and analysts are starting to take notice. In fact, in recent days, several analysts have come out with price target hikes, ratings adjustments, and plenty of maintained Buy ratings, or their equivalent. Investors were modestly pleased by this development as well, as shares ticked up fractionally in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

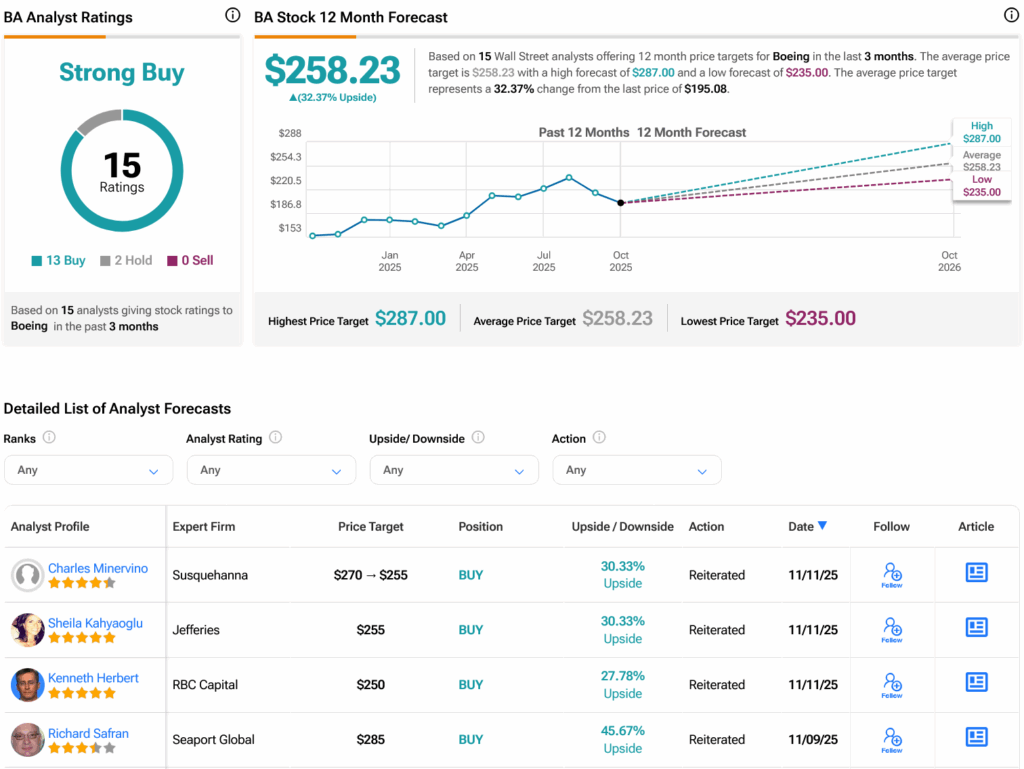

Earlier today, Charles Minervino, an analyst with Susquehanna who has a four-star rating on TipRanks, came out modestly on Boeing’s side. While Minervino’s assessment featured a solid overall picture, he did pare back his price target a bit. Minervino left the Positive rating in place, but lowered the price target from $270 to its new $255.

Minervino was hardly alone here. Freedom Capital Markets hiked the rating on Boeing from Hold to Buy, and upped the price target from its original $217 to $223. UBS left its Buy rating in place, but dropped the price target slightly from $280 to its new $275. JPMorgan did something similar, keeping Boeing at Overweight, but dropping the price target from $251 to $240. Finally, Bernstein bucked the trend, keeping Boeing at Outperform, but raising the price target from $249 to its new level of $282.

Please Vote Yes

New reports say that tomorrow will be the big day for the International Association of Machinists and Aerospace Workers (IAM) union, as the St. Louis strike passes the hundred-day mark. But a new offer out from Boeing should be going for a vote tomorrow, and the strike may end with it. In fact, the union is calling on its members to vote yes on Boeing’s proposed contract.

Reports note the new contract is much the same as the previous ones. The wage increase remains at 24% over the next five years, insurance costs that hold the line, and improvements to paid time off for vacation and illness. Boeing did sweeten the pot, though, with a $6,000 cash ratification bonus, unchanged service and sick leave anniversary dates, and an improved pay rate for paid holidays.

Is Boeing a Good Stock to Buy Right Now?

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 13 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 39.47% rally in its share price over the past year, the average BA price target of $258.23 per share implies 32.37% upside potential.