Shares of Boeing (BA) declined 1.5% on Friday as the company has paused deliveries of its 787 Dreamliners, according to the Wall Street Journal.

American Airlines (AAL) was expected to receive a new Dreamliner this week. However, the delivery cannot be fulfilled by Boeing until next week at the earliest.

The delay follows a recent 5-month suspension in deliveries of aircraft due to production issues. Last year, a review of Boeing’s Dreamliner production was initiated by the Federal Aviation Administration (FAA), which has increased scrutiny of the company’s 737 MAX manufacturing operations following earlier factory slip-ups.

The FAA recently requested more information about the company’s proposed solution for addressing previously identified quality lapses. (See Boeing stock analysis on TipRanks)

Boeing told the WSJ that it is working in a speedily and transparent manner to give out the details. The company is required to prove that its inspection method, which is time-consuming and labor-intensive, adheres to the federal safety regulations.

Last month, Boeing CEO David Calhoun revealed plans to deliver 10-12 Dreamliners every month. With the recent development, the company will most likely miss that target.

The delivery halt could bring further pressure on the company’s finances since customers usually pay most of the aircraft’s price on receipt of the aircraft.

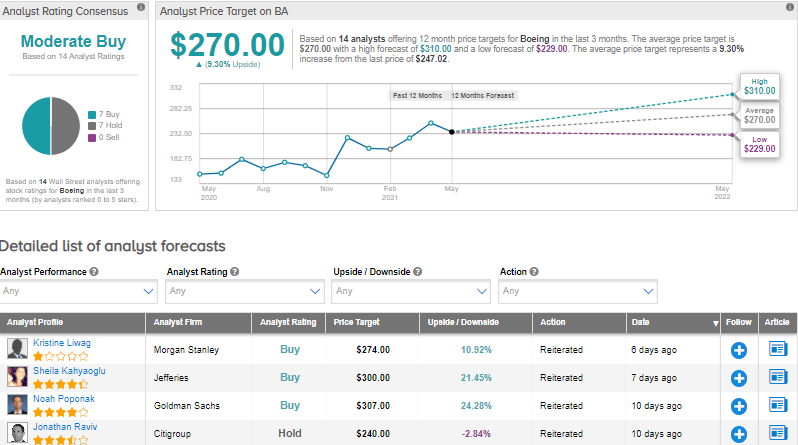

On May 25, Morgan Stanley analyst Kristine Liwag maintained a Buy rating and a price target of $274 (10.9% upside potential) on the stock.

Liwag believes that 737 aircraft are flying at an increasing number of airlines both in the U.S. and internationally. He added, “Airlines have shown some improvement in the number of flights following the grounding of 737 MAX planes in April. WoW, AAL had an increase of 29% while UAL had an increase of 46%.”

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 7 Holds. The average analyst price target of $270 implies 9.3% upside potential from current levels. Shares of Boeing have jumped 63.2% over the past year.

Related News:

Nutanix Posts Smaller-Than-Feared Quarterly Loss, Revenue Beats Estimates

Medtronic Posts a Blowout Quarter as Revenue Outperforms, Bumps up Dividend

Sanofi and GSK Commence Phase 3 Study of COVID-19 Vaccine Candidate