Boeing (BA) has been awarded a $657.2 million undefinitized contract action modification from the US Air Force to contract FA8634-18-C-2701 for the F-15Q Qatar program.

“The contract modification provides a comprehensive sparing program and contractor logistics support for the sustainment of the F-15QA aircraft. Logistical support for training devices and administrative costs are also included in this modification” the US Department of Defense states.

According to the announcement, work will be performed in Al-Udeid Air Base, Qatar.

Foreign Military Sales funds in the amount of $55,700,000 are being obligated at the time of award, while the total cumulative face value of the contract is $8,040,659,061.

The Air Force Life Cycle Management Center, Wright-Patterson Air Force Base, Ohio, is the contracting activity.

Shares of BA closed 13% higher on Monday due to a favorable update related to Pfizer-BioNTech’s potential coronavirus vaccine, trimming this year’s decline to 45%. BA is now rising a further 4% in Tuesday’s pre-market trading.

However the airline recently said that it expects passenger traffic to return to 2019 levels in only about 3 years. As a result, the US plane maker will need to continue with overall staffing cuts through natural attrition as well as voluntary and involuntary workforce reductions. (See BA stock analysis on TipRanks)

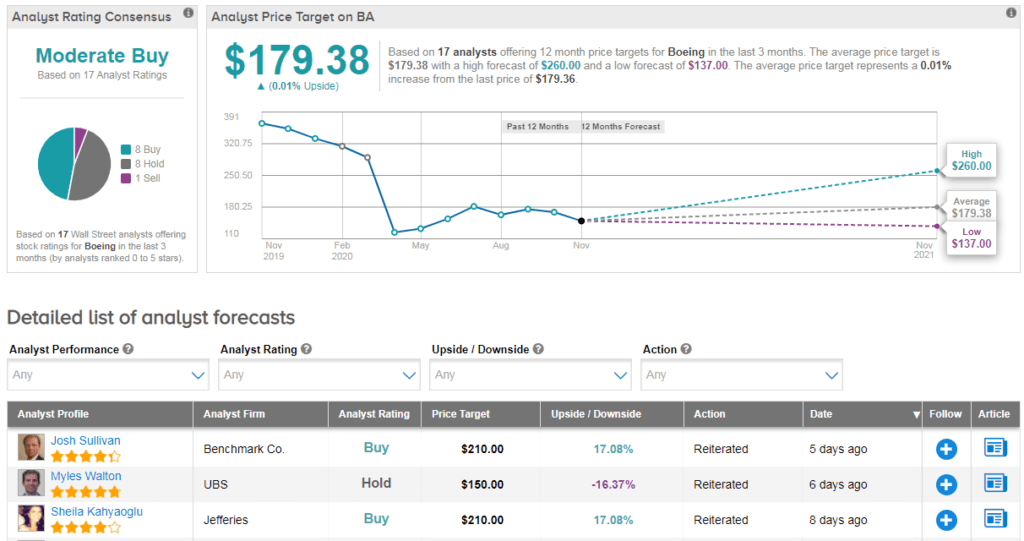

Cowen & Co analyst Cai Rumohr on Oct. 28 reiterated a Hold rating on the stock with a $150 price target (16% downside potential), saying that it’s still early to step back in to the stock.

“Increases in MAX and 787 inventories should become a source of cash starting in Q4 as deliveries start to ramp,” Rumohr wrote in a note to investors. “But delivery plans are fluid and there’s risk of additional downward adjustment to production plans. Because a major portion of expected positive cash flow in 2022-23 will come from inventory burnoff, the stock may drift until a delivery floor is in clear focus.”

The rest of the Street has a cautiously Moderate Buy analyst consensus on the stock. That’s with a $179.38 average analyst price target, suggesting that shares are fully priced at current levels.

Related News:

General Motors Embarks On Hiring Spree For EV Bonanza; Street Bullish

Nikola Says Partnership Talks With GM On Track; Shares Gain

Alibaba, Richemont To Invest $1.1B In Farfetch For China Push; Stock Up 323% YTD