Boeing (BA) has revealed that a further 60 737 MAX orders were canceled in the month of June due to the fallout from the ongoing coronavirus pandemic, bringing the total 737 cancellations this year to 373. The troubled planemaker had already announced 47 of the June cancellations.

According to Bloomberg, this figure did not account for Norwegian Air Shuttle ASA’s cancellation of all 97 of its remaining Boeing jets on order, as the deals have not yet been officially terminated. But the order backlog did exclude an additional 123 ‘orders in peril’ which could be called off.

During June, Boeing delivered just 10 aircrafts- which was nevertheless an improvement on May’s 4 deliveries. The company also announced that it delivered a total of 20 commercial airplanes for the second quarter of 2020, vs 90 in the same period last year. Net orders also remained negative with 182 net cancellations, bringing Q2 to 477, up from 307 in Q1.

For the second quarter, Boeing delivered seven of the 787 planes, 4 each of the 777, 767 and 737 and one 747. Year-to-date, Boeing has now delivered a total of 36 787 planes.

“Our commercial airplane deliveries in the second quarter reflect the significant impacts of the COVID-19 pandemic on our customers and our operations that included a shutdown of our commercial airplane production for several weeks,” commented Greg Smith, Boeing exec VP of Enterprise Operations.

“The diversity of our portfolio including our government services, defense and space programs will continue to provide some stability as we navigate through the pandemic and rebuild stronger on the other side” Smith added.

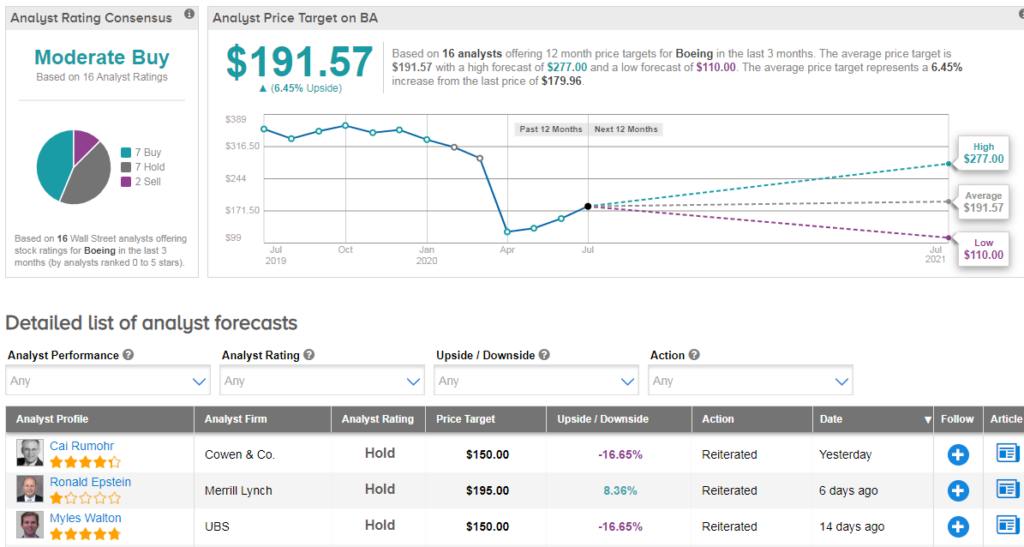

Shares in Boeing have plunged 45% year-to-date, but analysts have a cautiously optimistic Moderate Buy consensus on the stock. That’s with a $192 average analyst price target (6% upside potential). (See Boeing stock analysis).

For now Cowen & Co’s Cai Rumohr is sitting on the sidelines. “BA delivered only ten aircraft in June vs. four in May and our June est. of 28. The primary shortfall was in the 787, where BA delivered three 787’s vs. our est. of 16” he commented.

“We attribute the weak sequential lift to partial COVID-19 related reopenings, although flight restrictions and customer deferrals remain key issues” the analyst told investors on July 14. He has a bearish $150 price target on BA stock (17% downside potential).

Related News:

Airbus First-Half Deliveries Drop 49% Amid Covid-19 Aviation Crisis

Avolon Cancels 27 Of Boeing 737 Max Aircraft Order

Boeing: Don’t Expect a Recovery Anytime Soon, Says Analyst