Boeing (BA) has teamed up with Alaska Airlines (ALK) on the ecoDemonstrator program to test new technologies to enhance the safety and sustainability of air travel.

Starting this summer, the two will test a new halon-free fire-extinguishing agent designed to curb the negative impact on the ozone layer. They will also assess an engine nacelle aimed at reducing noise and assess cabin sidewalls made from durable recycled materials. (See Alaska Airlines stock analysis on TipRanks)

The airlines will work with nine other partners to test the new technologies. Once the tests are completed, the airplanes will be configured with the technologies and delivered to Alaska. (See Boeing stock analysis on TipRanks).

“Boeing is committed to continually improve air safety and the environmental performance of our products… We’re proud to collaborate with our hometown customer and other partners around the world this year to make flying more sustainable,” said Boeing Commercial Airplanes CEO Stan Deal.

Boeing’s ecoDemonstrator program has led to the development and testing of more than 200 promising technologies since 2012. Most of the innovations have helped address the aviation industry’s challenges and enhanced passengers’ flight experiences.

Some of the technologies developed as part of the ecoDemonstrator have been integrated into Boeing airplanes. One of the technologies, the Advanced Technology winglets, which reduce fuel use and emissions, are integrated into the 737 Max planes.

Yesterday, Morgan Stanley analyst Kristine Liwag reiterated a Buy rating on the stock. According to the analyst, Boeing is working on a new aircraft program that should help strengthen its competitive edge against the Airbus A321XLR. While a new aircraft program could add significant risk, the analyst believes a positive COVID-19 recovery trade will help offset any headwinds.

The analyst has a $274 price target on the stock implying 9.46% upside potential to current levels.

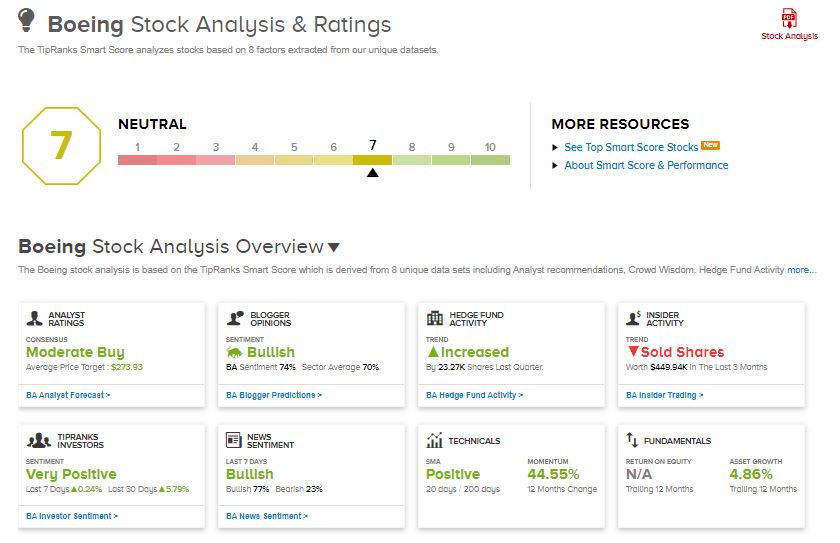

Consensus among analysts is a Moderate Buy based on 8 Buys and 6 Holds. The average analyst price target of $273.93 implies 9.43% upside potential to current levels.

BA scores a 7 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Accenture Expands in Southeast Asia with Entropia Buyout

Amazon Deepens Ties with Casino Group to Enhance Food E-Commerce in France

Tyler Technologies to Snap up VendEngine for $84M; Street Says Buy