Global investment firm Blackstone (BX) announced that it has entered into an agreement to acquire a majority ownership interest in online learning company Simplilearn Solutions Pvt. Ltd. The financial terms of the deal have been kept under wraps.

Following the news release, shares of the company declined 2.4% in Monday’s trading session, however, recovered slightly to close at $100.11 in the extended trading session.

Simplilearn’s expertise in providing new-age digital skills to professionals will strengthen Blackstone’s footing in the educational space.

A Senior Managing Director at Blackstone, Mukesh Mehta, said, “We have been impressed with Simplilearn’s synchronous model of pedagogy focused on delivering superior outcomes for its learners. Simplilearn has demonstrated strong, profitable growth and we want to turbocharge that growth through focused investments in technology, leveraging Blackstone’s global network and expertise in education technology and bringing to bear our relationships with global universities and enterprises.” (See Blackstone stock chart on TipRanks)

Recently, UBS analyst Adam Beatty reiterated a Buy rating on the stock. The analyst, however, raised the price target from $90 to $110, which implies upside potential of 10.3% from current levels.

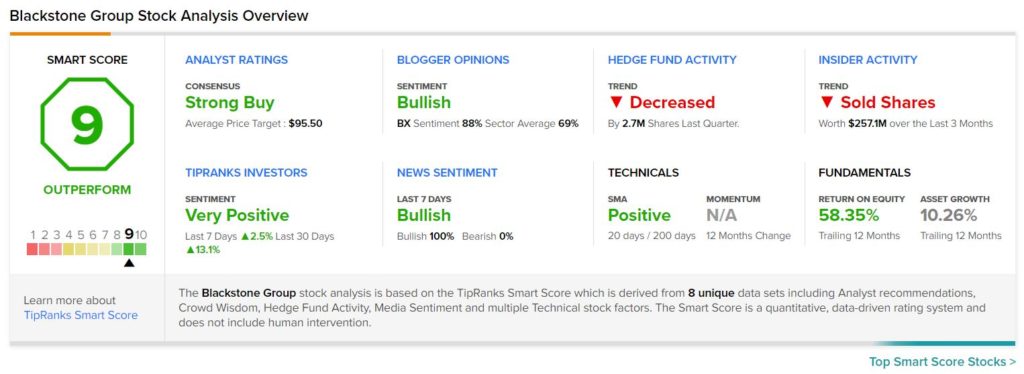

Consensus among analysts is a Strong Buy based on 9 Buys and 3 Holds. The average Blackstone price target of $95.50 implies downside potential of 4.2% from current levels.

Blackstone scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained about 77.7% over the past year.

Related News:

Zoom to Acquire Five9 for $14.7B

Interactive Brokers Aims to Attracts Individual Investors in Europe

Nokia to Grow 5G footprint in Taiwan with Taiwan Star Telecom