Private Equity firm Blackstone Group Inc. is in negotiations to merge Alight Solutions LLC with blank-check acquisition firm, Foley Trasimene Acquisition Corp, Reuters has learnt.

According to the talks, the merger if successful, would result in Alight becoming a publicly-listed company valued at over $8 billion, including debt, Reuters said. Blackstone Group (BX) acquired Alight in 2017 from insurance broker AON Plc for around $5 billion. According to the company’s website, Alight offers cloud-based benefits administration and human resources services to 30 million people in 188 countries.

A blank-check acquisition firm is a public company that is created specifically for the purpose of buying or merging with another company. Foley Trasimene was created for this purpose and raised $900 million in an initial public offering (IPO) in May without telling investors what company it intended merging with, according to the Reuters report.

All the companies involved declined to comment when approached by Reuters and questioned about a possible deal. (See BX stock analysis on TipRanks)

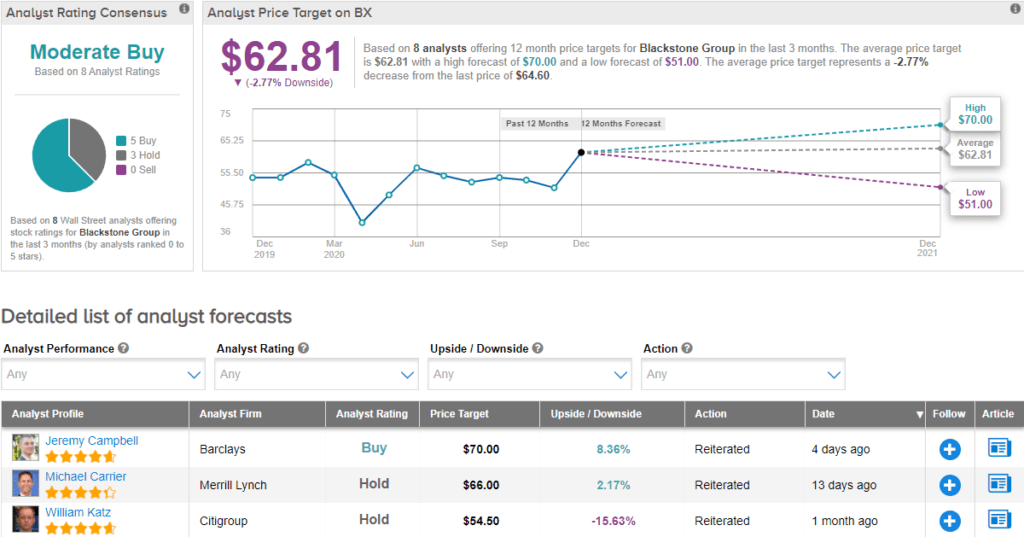

Barclays analyst Jeremy Campbell reiterated his Buy rating on BX last week and raised the price target from $64 to $70 (8% upside potential).

Consensus among analysts is a Moderate Buy based on 5 Buys and 3 Holds. The average price target of $62.81 implies downside risk of around 3% over the next 12 months.

Related News:

BNY Mellon To Resume Stock Buybacks; Shares Rise 5%

Boeing ‘Inappropriately Coached’ Pilots In 737 MAX Test – Report

Pfizer-BioNTech Covid-19 Vaccine Gets Green Light From Swiss Regulator