BlackRock (NYSE: BLK), the asset management company reported revenues of $4.3 billion, a decline of 15% year-over-year but still beating analysts’ estimates by $150 million. The fall in revenues was a result of lower performance fees and an appreciating dollar on average Assets Under Management (AUM)

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Adjusted earnings came in at $9.55 per share, a drop of 16% year-over-year. Analysts were expecting adjusted earnings of $7.06 per share.

However, Lawrence Fink, BlackRock’s Chairman, and CEO pointed out that in the first nine months of 2022, the company generated long-term net inflows of $248 billion, including $65 billion in Q3.

BlackRock’s bond Exchange Traded Funds (ETFs) also saw strong growth with net inflows of $37 billion.

Fink added, “Active strategies reflected momentum from significant outsourcing mandates and continued demand for alternatives, where we raised $6 billion across commitments and net inflows. We had record Aladdin client mandates in the first nine months of 2022, with over half coming from multi-product solutions.”

Is BlackRock a Buy or Sell?

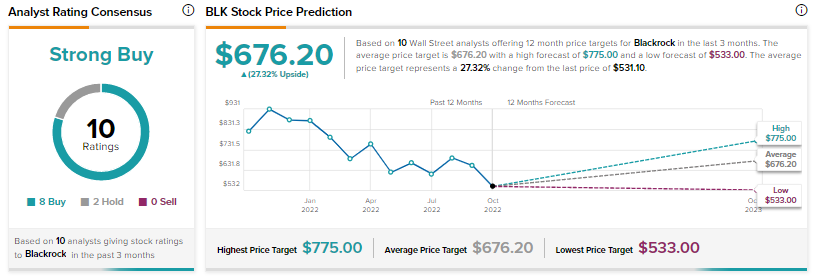

Wall Street analysts continue to be bullish about BlackRock with a Strong Buy consensus rating based on eight Buys and two Holds.

The average price forecast for BLK stock is $676.20 implying an upside potential of 27.3% at current levels.