Shares of BlackBerry dropped about 8.14% in Tuesday’s extended trading session after the security software and services provider reported 4Q revenues that missed Street estimates.

BlackBerry’s (BB) 4Q earnings of $0.03 per share declined 66.7% year-over-year and were in-line with the Street’s estimates. Lower top-line revenues and a contraction in gross and operating margins led to the earnings decline.

Adjusted revenues of $215 million fell 26.1% year-over-year and missed analysts’ estimates of $246.4 million. Adjusted software and services revenue declined 13.7% year-over-year.

The company’s CEO John Chen said, “We are seeing tangible signs that our efforts and improvements in go-to-market are starting to pay off and have a positive impact.” Chen added, “This quarter we generated strong sequential billings growth for our Software and Services business, including significant improvements for both Spark and QNX. Total billings are back to pre-pandemic levels.” (See BlackBerry stock analysis on TipRanks)

On Feb. 16, Canaccord Genuity analyst Michael Walkley cut his rating to Sell from Hold due to the recent run-up in the stock amid the improvement in the company’s security software business. Walkley lifted the price target to $10 (7.1% upside potential) from $8 as he expects a “gradual software and services recovery,” with positive revenue growth this year as the analyst expects an improvement in automotive sales.

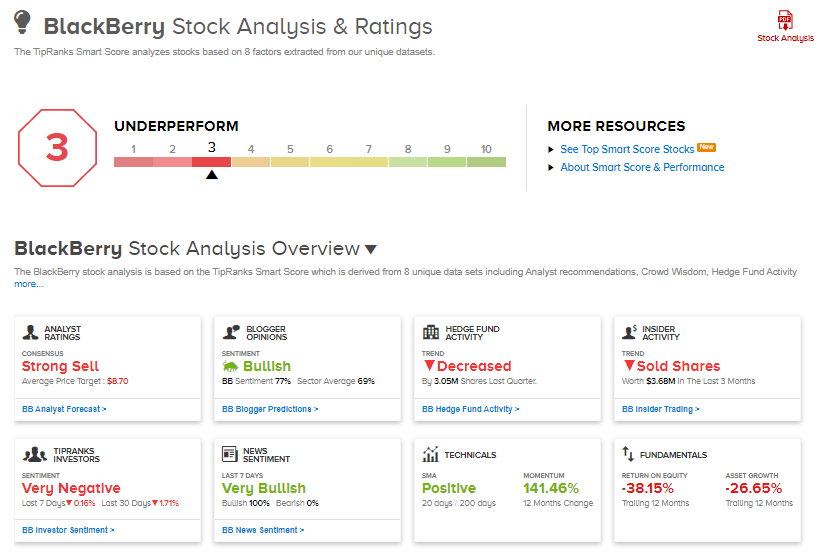

Meanwhile, the Street has a Strong Sell consensus rating on the stock based on 3 Sells. The average analyst price target of $8.70 implies downside potential of about 6.9% to current levels. Shares have gained over 145% in one year.

On TipRanks’ Smart Score ranking, BlackBerry gets a 3 out of 10 suggesting that the stock is likely to underperform market expectations.

Related News:

Canoo’s 4Q Loss Improves On Electric Vehicles Strength

McCormick’s 1Q Results Beat Expectations As Sales Outperform

Digi International Rises On Haxiot Acquisition; Street Remains Bullish