Membership-only warehouse club chain BJ’s Wholesale Club Holdings (NYSE: BJ) slid in pre-market trading as the company’s outlook left investors disappointed. BJ’s now expects its comparable club sales, excluding the impact of gasoline sales, to range from a decline of 2% to an increase of 1% year-over-year in the fourth quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In FY23, the company expects comparable sales to grow in the range of 1% to 1.8% year-over-year. BJ’s has projected its adjusted earnings to be between $3.80 and $3.92 per share in FY23.

Laura Felice, BJ’s Wholesale Club’s EVP and CFO, commented, “As we look ahead to the rest of the year, we remain confident in our ability to maintain the momentum in our traffic and market share gains due to our unrelenting focus on value.”

The retailer reported Q3 adjusted earnings of $0.98 per share, down by 1% year-over-year but above consensus estimates of $0.94 per share.

The company’s revenues increased by 2.9% year-over-year to $4.92 billion, beating Street estimates of $4.9 billion. In the third quarter, comparable club sales, excluding gasoline sales, remained flat year-over-year. The warehouse club chain’s membership fee income increased by 6.6% to $106.1 million in Q3.

Is BJ’s Wholesale a Good Stock to Buy?

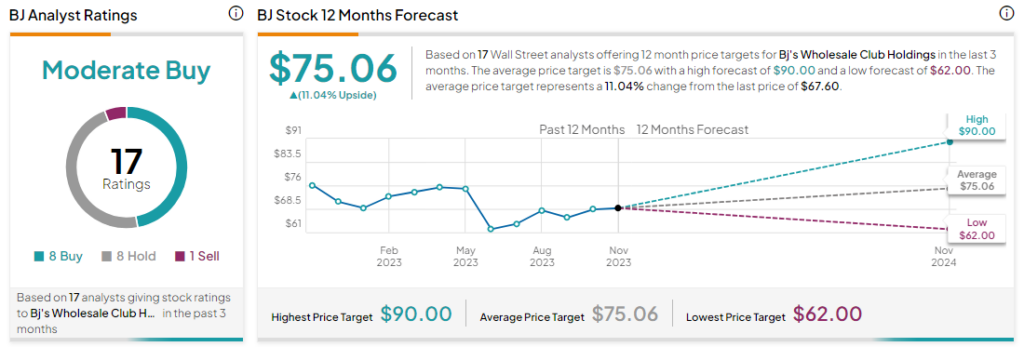

Analysts remain cautiously optimistic about BJ stock, with a Moderate Buy consensus rating based on eight Buys and Holds each and one Sell. BJ stock is down by more than 8% in the past year, but the average BJ price target of $75.06 implies an upside potential of 11% at current levels.