Bioventus Inc. posted better-than-expected 4Q results, driven by top-line growth. Shares of the medical device company rose 5.2% to close at $16.31 on March 25.

Bioventus’ (BVS) 4Q adjusted earnings were $2.32 per share, up 16% year-over-year, and comfortably beat analysts’ expectations of $0.23. Net sales of $98.6 million surpassed the Street’s estimates of $98.1 million and increased 1% from the year-ago period.

The company’s US net sales were up 3% year-over-year, while international net sales declined 17%. Additionally, adjusted gross margin was 79.7%, down 100 basis points. (See Bioventus stock analysis on TipRanks)

Bioventus CEO Ken Reali said, “We look forward to potential acceleration in our multi-year growth profile fueled by continued progress in our clinical, product development and new product pipeline and our pursuit of in-organic business development opportunities that are accretive to our long-term growth profile and leverage our significant customer presence across orthopedics, broaden our portfolio and increase our global footprint.”

For 2021, the company projects adjusted earnings to be in the range of $43 million to $46 million. Net sales are expected to land between $360 million and $372 million.

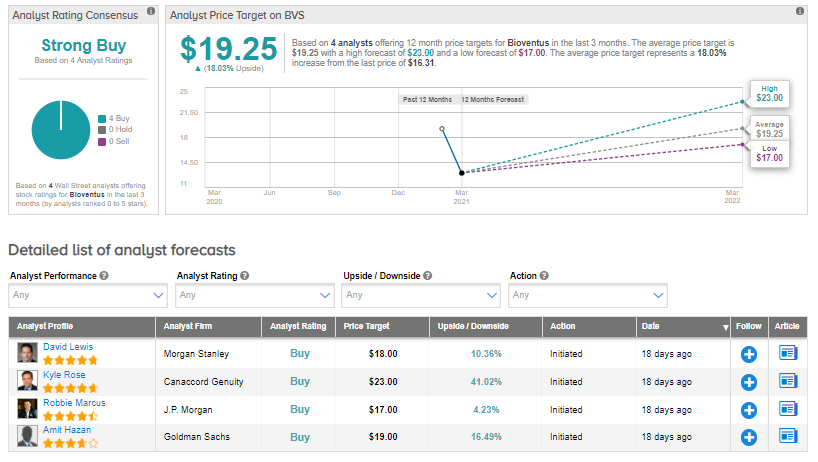

On March 8, Canaccord Genuity analyst Kyle Rose initiated coverage of the stock with a Buy rating and a price target of $23 (41% upside potential).

Rose said, “We see myriad opportunities for accelerating revenue share gains across BVS’ multiple end markets, which when combined with strong gross margins and operating metrics, position the company as a unique asset amongst its peers.”

Furthermore, the analyst believes “the current valuation represents a compelling entry point.”

The consensus rating among analysts is a Strong Buy based on 4 unanimous Buys. The average analyst price target stands at $19.25 and implies upside potential of 18% to current levels over the next 12 months.

Related News:

Ollie’s 4Q Results Beat Analysts’ Expectations As Sales Pick Up; Shares Gain After-Hours

GameStop’s Quarterly Results Disappoint; Shares Drop 15% After-Hours

aTyr Pharma Pops 6% On Lower-Than-Feared Quarterly Loss, Revenue Outperforms