Medical technology firm Biotricity, Inc. (NASDAQ:BTCY) has announced the availability of its new Bioheart heart monitor system on Amazon.com (AMZN). The direct-to-consumer device offers the same continuous heart monitoring technology that physicians use.

The company started selling the Bioheart device last month and roped in Amazon to boost availability and outreach. The system is listed on Amazon for $199 and is available at a discounted price of $149 for a limited time.

The Founder and CEO of Biotricity, Waqaas Al-Siddiq, said, “The Bioheart device is an important component of our full spectrum, virtual cardiac clinic of mobile cardiac care and lifestyle solutions. It will be fully integrated with a growing number of cardiology practices through our cloud-based Biosphere ecosystem that we plan to fully roll out in 2022, allowing physicians to get a more holistic view of a patient’s health.”

Meanwhile, the company has completed a non-convertible debt financing of $12 million. Texas-based financing firm SWK Holdings Corp.’s (SWKH) subsidiary SWK Funding has provided the capital to Biotricity for a period of five years.

The terms of the deal include interest payment for two years and a principal balloon payment of 40% at the end of five years.

Biotricity plans to use the funds to finance its annual recurring revenue (ARR) subscriptions, support the inventory and replace the existing debt.

About Biotricity

Based out of California, Biotricity offers biometric data monitoring solutions. Its product portfolio includes Bioflux, a single-unit mobile cardiac telemetry device, and Biolife, which is intended for chronic disease prevention.

The stock closed 1.2% higher on Tuesday but lost 3.2% in aftermarket hours to end the day at $4.25.

Wall Street’s Take

Last month, H.C. Wainwright analyst Kevin Dede initiated coverage on the stock with a Buy rating and a price target of $6 (36.7% upside potential).

The analyst said, “We are initiating coverage of Biotricity with a Buy rating and setting a potentially conservative $6 price target not only on account of the horizontal expansion marketing its solution in cardiac care to 25,000 U.S. physicians but also on the profound trajectory toward the full ecosystem of care monitoring solutions for cardiac-related and/or influenced chronic conditions such as diabetes, hypertension, kidney disease, among others.”

Overall, the stock has a Moderate Buy consensus rating based on 2 Buys. The average BTCY price target of $6.50 implies 48.1% upside potential. Shares have gained 501.4% over the past year.

Investor Opinions

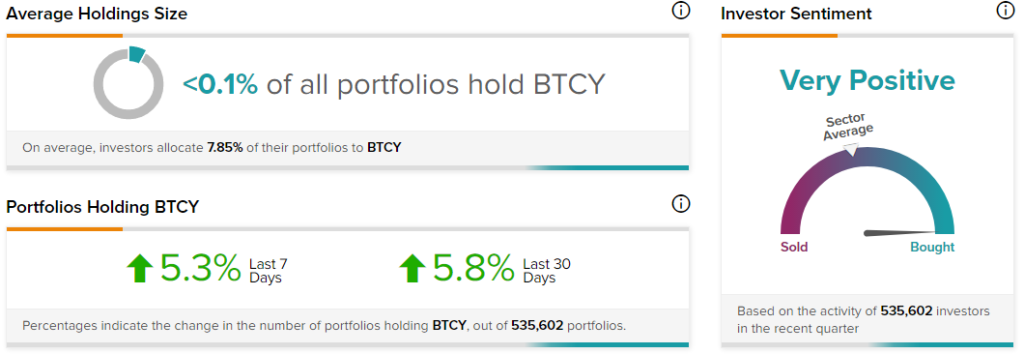

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Biotricity, with 5.8% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

Related News:

Dynavax Announces Biological E’s COVID-19 Vaccine Approval For Emergency Use in India

Canadian Pacific Extends Multi-Year Contract with Canadian Tire

Flotek Industries Pops 50% After Receiving Unsolicited Indication of Interest