Shares of BioLife Solutions were up 16.7% in Monday’s extended trading session after the company, which develops and supplies bioproduction tools for the cell and gene therapy industry, provided FY21 a revenue outlook that fared better than analysts’ expectations. Moreover, the company reported better-than-expected results for the fourth quarter.

BioLife Solutions (BLFS) reported an adjusted loss of $0.01 per share in 4Q, compared with the year-ago earnings of $0.13 per share, due to lower adjusted gross margins and higher operating expenses. Analysts were expecting a loss of $0.02 per share.

Revenues jumped about 78% year-over-year to $14.7 million and came in ahead of consensus estimates of $13.5 million.

The company’s CFO and COO Roderick de Greef said, “Despite a negative impact on capital equipment product revenue due to COVID-19 restrictions on in-person customer meetings throughout most of 2020, our media business grew consistently, increasing 32% compared with 2019 and contributing to very strong overall revenue growth.”

The company also announced the acquisition of Stirling Ultracold, which is expected to boost its revenues. The company’s CEO Mike Rice said, “we expect to surpass our goal of $100 million in total revenue this year and expect to reach $250 million in total revenue in the next three to four years.”

As for 2021, the company expects to generate revenues in the range of $101 million to $110 million, implying year-over-year growth of 110% to 129%. Analysts were expecting revenues of $69.5 million. (See BioLife Solutions stock analysis on TipRanks)

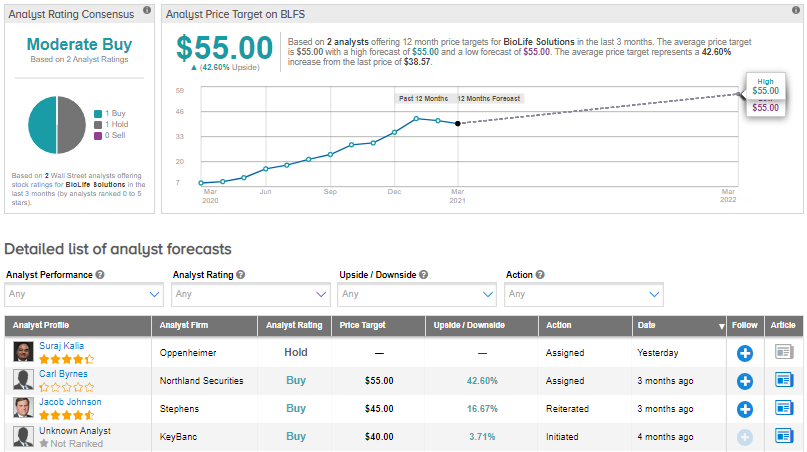

Following the results, Oppenheimer analyst Suraj Kalia maintained a Hold rating on the stock. In a note to investors, the analyst said that the uncertainty over the future revenues and slowdown in margins keeps him sidelined.

Overall, the Street has a Moderate Buy consensus rating on the stock based on 1 Buy and 1 Hold. The average analyst price target of $55 implies upside potential of about 42.6% to current levels. Shares have rallied by 323% in one year.

Related News:

Santander To Pay Special Dividend Of $0.22 Per Share

PPL To Divest U.K. Utility Business For $10.5B

Hartford Receives Takeover Bid From Chubb