Biogen’s share price fell 4% on Thursday after the company reported first-quarter financial results and increased its full-year earnings guidance. The biotechnology company says financial results were consistent with expectations despite reporting a 24% decline in revenues.

Total revenue came in at $2.69 billion as multiple sclerosis revenue declined 26% year-over-year to $1.69 billion. SPINRAZA revenues were down 8% to $521 million. Biosimilars revenue decreased 6% to $205 million. Biogen (BIIB) reported $410 million in net income, or $2.69 a share.

Despite the revenue slump in the quarter, CEO Michel Vounatsos expects 2021 to be a transformative year.

Vounatsos stated, “With an anticipated regulatory decision for aducanumab in the U.S. and a number of exciting pivotal readouts expected this year in depression, choroideremia, and ALS, we continue to believe that 2021 will be a transformative year for Biogen.”

Biogen has also updated its full-year guidance. 2021 revenue is expected to remain flat compared to previous guidance and average between $10.45 billion and $10.75 billion. Non-GAAP diluted EPS is expected between $17.50 and $19 against previous guidance of between $17.0 and $18.50.

The financial guidance assumes a currency headwind of about $80 million due to the strengthening of the US dollar, and also assumes that Biogen will secure regulatory approval for aducanumab, its candidate drug for Alzheimer’s disease.

Biogen shares are up 6% year-to-date after a 17.56% drop in 2020. (See Biogen stock analysis on TipRanks).

Following the earnings release, JPMorgan’s analyst Cory Kasimov reiterated a Neutral rating with a price target of $269, implying 3.86% upside potential.

Commenting on the earnings, Kasimov said, “it was an uneventful

1Q ahead of what is going to be a VERY eventful 2Q (aducanumab PDUFA of 6/7/21– in case you forgot – as well as Phase 3 zuranolone MDD data)”.

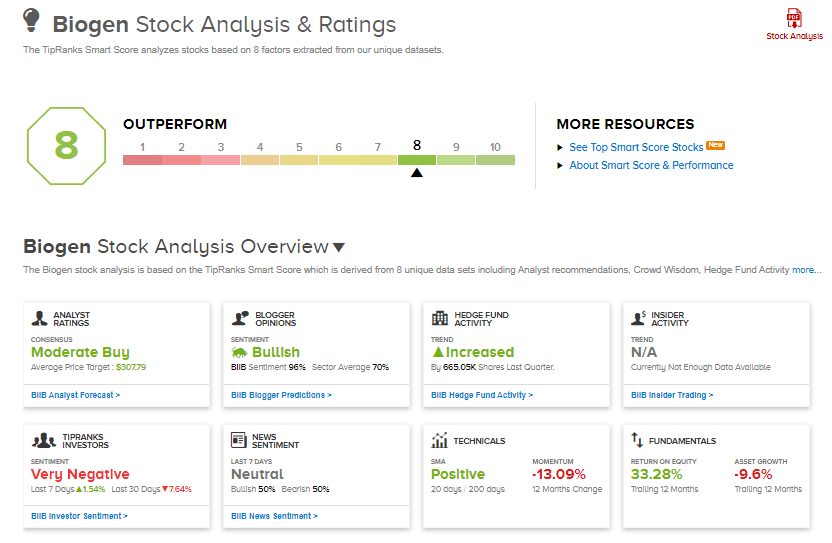

Consensus among analysts is a Moderate Buy based on 10 Buy, 9 Hold, and 3 Sell ratings. The average analyst price target of $307.79 implies 18.84% upside potential to current levels.

BIIB scores an 8 out of 10 on the TipRanks’ Smart Score rating system, implying that the stock is expected to outperform market averages.

Related News

Tesla’s Solar Panels To Be Sold Exclusively With Powerwall Battery – Report

INVO Partners With Lyfe Medical To Expand INVOcell Solution In Northern California

Abbott Starts Shipping Over-The-Counter COVID-19 Self-Test