Software-as-a-service (SaaS) e-commerce platform BigCommerce Holdings, Inc. (NASDAQ: BIGC) has posted mixed results for the fourth quarter ended December 31, 2021, as earnings miss but revenues surpass estimates.

Following the results, shares of the company declined 16.2% to close at $21.70 in Monday’s extended trading session.

Revenue & Earnings

BigCommerce reported quarterly revenues of $64.9 million, up 50% from the same quarter last year. Further, the figure surpassed the consensus estimate of $61.82 million. The strong revenue growth was marked by the 58% year-over-year rise in subscription revenues to $46.9 million.

The company’s loss per share for the quarter widened to $0.17 from $0.12 a year ago. Further, the figure came in wider than the consensus estimate of a loss per share of $0.12.

Other Operating Metrics

BigCommerce’s total annual revenue run-rate (ARR) witnessed a rise of 48% from the previous year to $268.7 million.

Further, the average revenue per account of the accounts exceeding $2,000 in annual contract value (ACV) rose 27% from the prior year to $18,598.

Outlook

For the first quarter of 2022, the company forecasts revenues between $61.9 million and $65.1 million against the consensus estimate of $63.83 million.

For full-year 2022, BigCommerce anticipates revenues in the range of $271.6 million to $283.6 million versus the consensus estimate of $277.79 million.

CEO Comments

The CEO of BigCommerce, Brent Bellm, said, “Q4 was another outstanding quarter for BigCommerce as our revenue grew to $64.9 million, up 50% year-over-year. This growth reflects the flexibility and performance of our Open SaaS platform and the continued execution of our top strategic priorities, particularly international expansion and enterprise growth. Our revenue in EMEA grew by 60% and revenue in APAC increased 54% compared to the fourth quarter of 2020. ARR from enterprise accounts was up 72% over the end of 2020.”

Stock Rating

Overall, the Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 7 Buys and 3 Holds. The average BigCommerce price target of $56.22 implies that the stock has upside potential of 117.1% from current levels. Shares have declined 58.7% over the past year.

Website Traffic

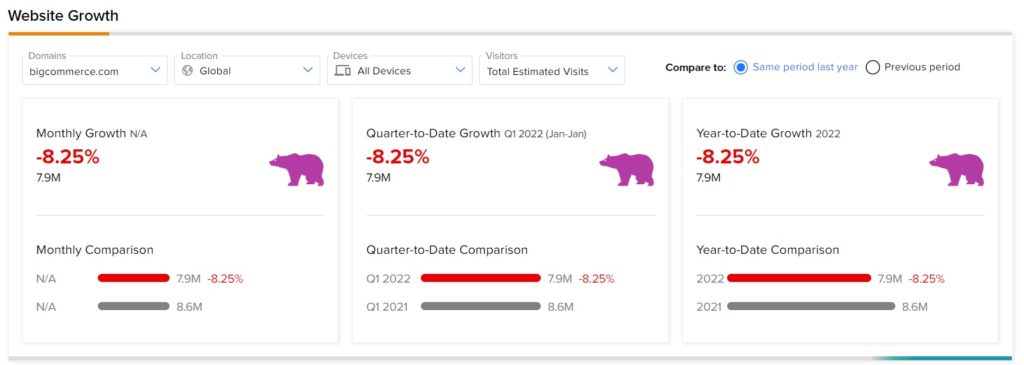

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into BigCommerce’s performance this quarter.

According to the tool, year-to-date, the BigCommerce website traffic recorded a decline of 8.25%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

TD Bank Buys First Horizon

Chevron Enters All-Cash Deal to Acquire Renewable Energy Group

Cinemark Holdings’ Q4 Results Exceed Expectations